PRIVACY ACT STATEMENT

AUTHORITY: 5 U.S.C. 301, Departmental Regulations; 10 U.S.C., Chapters 53, 61, 63, 65, 67, 69, 71, 73, 74; 10 U.S.C. Sec. 1059, and

1408(h); 38 U.S.C. Sec. 1311 and 1313; Pub. L. 92-425; Pub. L. 102-484 Sec. 653; Pub. L. 103-160 Sec. 554 and 1058; Pub. L. 105-261, Sec.

570; DoDI 1342.24, Transitional Compensation for Abused Dependents; DoD Financial Management Regulation 7000.14-R, Volume 7B and

E.O. 9397 (SSN).

PRINCIPAL PURPOSE(S): This form is used to determine the beneficiaries of a deceased military retiree for entitlement of unpaid retired pay.

Applicable SORNs: T7347b.

ROUTINE USE(S): Certain "Blanket Routine Uses" for all DoD maintained systems of records have been established that are applicable to

every record system maintained within the Department of Defense, unless specifically stated otherwise within the particular record system

notice. These additional routine uses of the records are published only once in each DoD Component's Preamble in the interest of simplicity,

economy and to avoid redundancy.

DISCLOSURE: Voluntary; however, failure to furnish the requested information will result in delays in payment of arrears of retirement pay, as

well as the inability to pay the designated beneficiary. The Social Security Numbers are required to correctly identify the retiree and

beneficiaries.

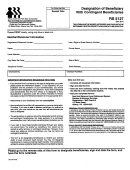

INSTRUCTIONS

This form is intended to apply to any amounts you are due as a retired member on the date of your death, including retired pay

and, if you are eligible, Combat-Related Special Compensation (CRSC). References to unpaid retired pay in this form include

CRSC, if applicable. Entitlement to retired pay stops on the date of your death. CRSC payments terminate on the first day of

the month in which you die. In order to determine who should receive any retired pay or CRSC you are owed when you die, this

form should be completed and returned to:

Defense Finance and Accounting Service

U.S. Military Retired Pay

8899 E. 56th Street

Indianapolis, In 46249-1300

By law, you may designate a beneficiary or beneficiaries you wish to receive your unpaid retired pay. If you specifically elect to

designate a beneficiary or beneficiaries, you must list the names of the beneficiaries you desire in the top part of the form (Item

2), their relationship to you (Item 4), their SSN (if available) (Item 3), and their address (Item 5). You can either provide a

SHARE percentage to be paid to each person or leave the SHARE percentage blank. If you leave the SHARE percentage

blank, any retired pay you are owed when you die will be divided equally among your designated beneficiaries. Complete all

other requested information. If you list more than one person with a 100% SHARE, we will pay in the order of the beneficiaries

as you list them on the form. If, for example, you designate two beneficiaries, then the SHARE percentage can be blank, 100%

for each beneficiary, or the SHARE percentages when added together must equal 100%. Similarly, if you designate three

beneficiaries, then the SHARE percentage can be blank or equal one of the following combinations: 100% for each of the

beneficiaries; or, if you designate 100% for one of the beneficiaries, the sum of the SHARE percentage for the remaining two

must equal 100%; or, the sum of the SHARE percentage for all three beneficiaries must be 1/3 each. If you designate

beneficiaries, you should update your beneficiary information whenever there is a change in your marital status or whenever you

choose different beneficiaries.

If you designate more than 5 beneficiaries, you must submit your beneficiary designation in a signed letter to the return address

listed above. To be valid, a beneficiary designation must be received by DFAS before the date of your death.

If you are not specifically designating beneficiaries, complete the bottom of the form (Item 3) with the Name, Social Security

Number (if available), Relationship and Address of your living family members who may be contacted upon your death regarding

the unpaid retired pay. The names provided should include spouse, children, parents and siblings. If you do not elect to

specifically designate beneficiaries to receive your unpaid retired pay upon your death, or the designated beneficiary dies before

you, the amount due will be paid to the person or person(s) highest on the following list living at the time of your death: (1) your

spouse; (2) your children and their descendants, by representation; (3) your parents, in equal parts, or if either is dead, the

survivor; (4) the legal representative of your estate; and (5) persons entitled under the law of your domicile. When you complete

the form, you must enter your Social Security Number and sign the form. Forms or letters that contain incorrect SHARE

percentages will be returned for correction. Forms or letters that do not contain your Social Security Number or your signature

will be returned to you unprocessed.

DD FORM 2894 (BACK), APR 2017

1

1 2

2