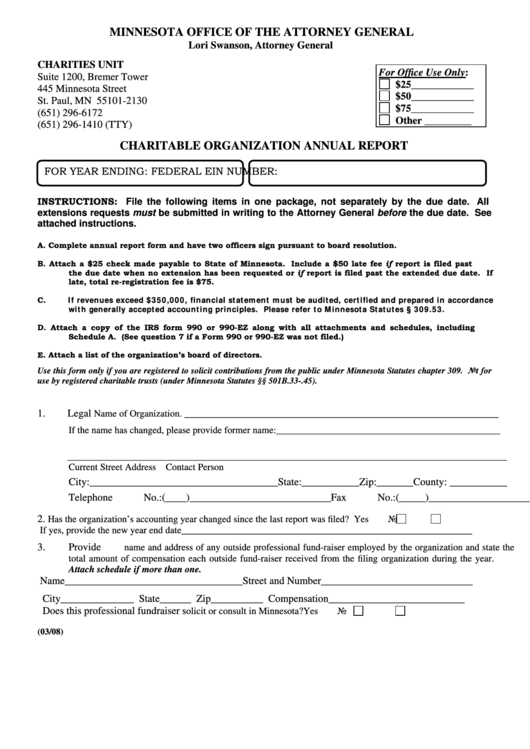

MINNESOTA OFFICE OF THE ATTORNEY GENERAL

Lori Swanson, Attorney General

CHARITIES UNIT

For Office Use Only:

Suite 1200, Bremer Tower

$25____________

445 Minnesota Street

$50____________

St. Paul, MN 55101-2130

$75____________

(651) 296-6172

Other _________

(651) 296-1410 (TTY)

CHARITABLE ORGANIZATION ANNUAL REPORT

FOR YEAR ENDING:

FEDERAL EIN NUMBER:

INSTRUCTIONS:

File the following items in one package, not separately by the due date. All

extensions requests must be submitted in writing to the Attorney General before the due date. See

attached instructions.

A.

Complete annual report form and have two officers sign pursuant to board resolution.

B.

Attach a $25 check made payable to State of Minnesota. Include a $50 late fee if report is filed past

the due date when no extension has been requested or if report is filed past the extended due date. If

late, total re-registration fee is $75.

If revenues exceed $350,000, financial statement must be audited, certified and prepared in accordance

C.

with generally accepted accounting principles. Please refer to Minnesota Statutes § 309.53.

D.

Attach a copy of the IRS form 990 or 990-EZ along with all attachments and schedules, including

Schedule A. (See question 7 if a Form 990 or 990-EZ was not filed.)

E .

Attach a list of the organization’s board of directors.

Use this form only if you are registered to solicit contributions from the public under Minnesota Statutes chapter 309. Not for

use by registered charitable trusts (under Minnesota Statutes §§ 501B.33-.45).

1.

Legal

Name of Organization. __________________________________________________________________

If the name has changed, please provide former name: _______________________________________________

____________________________________________________________________________________

Current Street Address

Contact Person

City:____________________________________State:___________Zip:_______County: ___________

Telephone No.:(____)___________________________Fax No.:(_____) _________________________

2.

Has the organization’s accounting year changed since the last report was filed? Yes

No

If yes, provide the new year end date _____________________________________________________________

3.

Provide

name and address of any outside professional fund-raiser employed by the organization and state the

total amount of compensation each outside fund-raiser received from the filing organization during the year.

Attach schedule if more than one.

Name__________________________________Street and Number _____________________________

City ______________ State ______ Zip__________ Compensation __________________________

Does this professional fundraiser s

olicit or consult in Minnesota? Yes

No

(03/08)

1

1 2

2 3

3 4

4