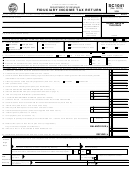

Form Fr-1000 - Arena Fee Return - 2001 Page 3

ADVERTISEMENT

SPECIFIC INSTRUCTIONS

LINE A - TAX YEAR -

D.C. APPORTIONMENT FACTOR:

If you report income on a calendar year basis, enter the year 2000. If you report

Persons or entities unable to determine their D.C. Gross Receipts because they

income on a fiscal year basis, enter the beginning and ending dates of your last

are not required to file either a D.C. Corporation Franchise Tax Return (D-20) or

fiscal year that ended on or before June 15, 2001.

a D.C. Unincorporated Business Franchise Tax Return (D-30), may apportion

and allocate gross receipts to the District of Columbia by using the allocation and

LINE B - D.C. BUSINESS TAX REGISTRATION NUMBER -

apportionment regulations under sections 122-129.16 of Volume 9 of the D.C.

Enter your D.C. Business Tax Registration Number on Line B.

Code of Municipal Regulations. If this apportionment factor does not accurately

reflect the D.C. Gross Receipts of your business, you may apply another appor-

LINE C - FEDERAL EMPLOYER I.D. NUMBER / SOCIAL SECURITY NUMBER-

tionment factor that does clearly and accurately reflect your operation’s D.C.

Enter your Federal Employer Identification Number or the Social Security Number

Gross Receipts. For example, a partnership or sole proprietor may apply an

(if self-employed) on line c.

apportionment factor against gross receipts of billable hours from within the

District over billable hours from everywhere. A tax-exempt entity required to pay

LINE D - AMOUNT ENCLOSED -

the Arena Fee based on unrelated business income, may apply an apportion-

Enter the amount of the Arena Fee payment which you have enclosed with the

ment factor of unrelated business income from D.C. sources over unrelated

Arena Fee return.

business income from everywhere.

LINE 1 - Enter the total amount of your D.C. Gross Receipts for the tax year

If you generate gross receipts exclusively within the District of Columbia, then,

shown on the return.

for the purpose of determining D.C. Gross Receipts subject to the Arena Fee,

enter “1” on the line for the D.C. Apportionment Factor in the worksheets.

D.C. GROSS RECEIPTS include all income derived from sources in the District of

Columbia, whether or not compensated in the District of Columbia, before the

You must submit along with this return, the worksheets and computations used

deduction of any expense connected with the production of such income,

to determine your D.C. Gross Receipts and the D.C. Apportionment Factor.

except merchandise returns and allowances.

LINE 2 - Use the ARENA FEE SCHEDULE in the General Instructions to determine

DETERMINING YOUR D.C. GROSS RECEIPTS:

the amount to enter on Line 2.

If you file either a D.C. Form D-20 or a D.C. Form D-30, you may calculate D.C.

Gross Receipts either by completing worksheet (C) or by computing the

LINE 3 - Compute the penalty at 5% of the Arena Fee due for each full or partial

following:Form D-20 filers use the amount shown in Schedule F, Line 3, Column

month that the return or payment is late. If the amount exceeds 25% of the Arena

2; Form D-30 filers use the amount shown on Schedule F, Line 3, Column 2. To

Fee, enter as the penalty 25% of the Arena Fee due.

this amount add any income of a non-business nature that is allocable to or

sourced within the District. Attach a copy of any D.C. apportionment factor

LINE 4 - Compute the interest at 1.083% of the Arena Fee due for each full or

worksheet and also any computation worksheet used in determining allocable

partial month that the payment is late.

income. For filers of Forms D-20 and D-30, the D.C. apportionment factor is the

Sales Factor . See page 4 (Schedule F) of these forms for tax year 2000 if this

LINE 5 - Enter the sum of Lines 2, 3, and 4.

factor accurately reflects the D.C. Gross Receipts of the business.

If you do not file either a D.C. Form D-20 or a D.C. Form D-30, use the appropriate

Arena Fee worksheet on the back of the Arena Fee Return.

For information call (202) 727-4TAX (4829)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3