Form 541-T Draft - California Allocation Of Estimated Tax Payments To Beneficiaries - 2015 Page 2

ADVERTISEMENT

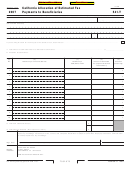

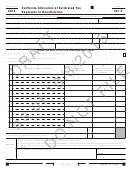

California Allocation of Estimated Tax

FORM

TAXABLE YEAR

2015

541-T

Payments to Beneficiaries

For calendar year 2015 or fiscal year beginning (mm/dd/yyyy)

and ending (mm/dd/yyyy)

Name of estate or trust

FEIN

-

Name and title of fiduciary

Additional information (see instructions)

Street address of fiduciary (number and street) or PO box

Apt . no ./ste . no .

PMB/private mailbox

City

State

ZIP code

Foreign country name

Foreign province/state/county

Foreign postal code

-

Calendar year trusts: File this form no later than March 7, 2016.

If you are filing this form for the final year of the estate or trust, check this box

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 Total amount of estimated taxes to be allocated to beneficiaries . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ___________________

2 Allocation to beneficiaries:

(a)

(b)

(c)

(d)

(e)

No.

Beneficiary’s name and address

Beneficiary’s

Amount of estimated

Proration

SSN/ITIN or FEIN

tax payment allocated to

percentage

beneficiary

1

%

2

%

3

%

4

%

5

%

6

%

7

%

8

%

9

%

10

%

3

3 Total from additional sheets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4 Total amounts allocated . (Must equal line 1, above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested information, go to

ftb.ca.gov and search for privacy notice . To request this notice by mail, call 800 .852 .5711 .

Under penalties of perjury, I declare that I have examined this allocation, including accompanying schedules and statements, and to the best of my

Sign Here

knowledge and belief, it is true, correct, and complete . Declaration of preparer (other than taxpayer) is based on all information of which preparer has

any knowledge .

Signature of fiduciary or officer representing fiduciary

Date

Telephone

X

(

)

Form 541-T C1 2015

7031153

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3