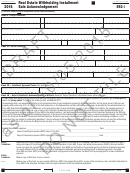

California Form 593-I Draft - Real Estate Withholding Installment Sale Acknowledgement - 2016 Page 3

ADVERTISEMENT

2016 Instructions for Form 593-I

Real Estate Withholding Installment Sale Acknowledgement

What’s New

A Purpose

Specific Instructions

I

Penalty Increase - For taxable years beginning

Use Form 593-

, Real Estate Withholding

Private Mail Box (PMB) – Include the PMB

on or after January 1, 2016, the penalties

Installment Sale Acknowledgement, to

in the address field. Write “PMB” first, then

related to failure to file information returns

acknowledge the buyer’s/transferee’s

the box number. Example: 111 Main Street

have increased. See General Information B,

requirement to withhold on the principal

PMB 123.

Interest and Penalties, or get FTB Pub. 1150,

portion of each installment payment to the

Foreign Address – Follow the country’s

Withhold at Source Penalty Information, for

seller/transferor for the sale of California real

practice for entering, the city, county, province,

more information.

property. The buyer/transferee is required to

state, country, and postal code, as applicable,

withhold at either the rate of 3

/

% (.0333)

1

3

in the appropriate boxes. Do not abbreviate the

General Information

of the total sales price or the Optional Gain

country name.

on Sale withholding percentage, as specified

When California real estate is sold on an

Buyer/Transferee Instructions

by the seller/transferor on Form 593. The

installment basis, the buyer/transferee is

buyer/transferee provides acknowledgement

required to withhold on the principal portion of

I

Form 593-

, Parts I, II, III, and IV should only

by signing Part IV.

each installment payment, an amount based on

be completed by the buyer/transferee. Forms

either 3

/

% (.0333) of the total sales price, or

The withholding agent retains this form for a

1

3

are updated annually. Make certain that the

the Optional Gain on Sale withholding amount

minimum of five years and must provide it to

most current version of the form is being used.

from Form 593, Real Estate Withholding Tax

the FTB upon request.

The buyer/transferee must withhold on the

Statement, line 5. If an exemption applies,

B Interest and Penalties

principal portion of each installment payment.

no withholding is required. There is no

However, the buyer/transferee may authorize

withholding on the interest portion of the

Interest will be assessed on late withholding

the REEP to withhold on the principal portion

installment payment.

payments and is computed from the due

of the first installment payment. In this case

Real Estate Escrow Person (REEP) – REEP

date to the date paid. If the REEP does not

the buyer/transferee withholds on the principal

is any person involved in closing the real

notify the buyer/transferee of the withholding

portion of all subsequent payments (including

estate transaction which includes any attorney,

requirements in writing, the penalty is the

payoff or balloon payments).

escrow company, or title company, or any

greater of $500 or 10% of the required

After completing the form, the buyer/transferee

other person who receives and disburses

withholding.

should copy all pages to have the instructions

payment for the sale of real property.

If after notification, the buyer/transferee or

for withholding on subsequent payments.

Installment Sales – The withholding agent is

other withholding agent does not withhold,

The buyer/transferee will give the original

required to report the sale or transfer as an

the penalty is the greater of $500 or 10% of the

I

Form 593-

, a copy of the promissory note, the

installment sale if the transaction is structured

required withholding.

seller’s/transferor’s Form 593, and Form 593-V,

as an installment sale as evidenced by a

If the buyer/transferee or other withholding

Payment Voucher for Real Estate Withholding,

promissory note. The withholding agent is

agent does not furnish complete and correct

to the REEP. The REEP will mail the documents

required to withhold 3

/

% (.0333) of the first

1

3

copies of Form 593 to the seller/transferor by

to the FTB with the withholding on the principal

installment payment.

the due date, the penalty is $100 per Form 593.

portion of the first installment payment to:

Buyers/Transferees are required to withhold

If the failure is due to an intentional disregard

FRANCHISE TAX BOARD

on the principal portion of each subsequent

of the requirement, the penalty is the greater

PO BOX 942867

installment payment if the sale of California real

of $250 or 10% of the required withholding.

SACRAMENTO CA 94267-0651

property is structured as an installment sale.

We assess a penalty for failure to file complete,

When making subsequent installment

Withhold on Installment Sale Elect-out

correct, and timely information returns. The

payments, withhold either 3

/

% (.0333) of the

1

3

Method – If the seller/transferor elects not

penalty is calculated per seller:

total sales price, or the Optional Gain on Sale

to report the sale on the installment method

• $30 if filed 1 to 30 days after the due date.

withholding percentage, as specified by the

(Internal Revenue Code Section 453[d]), the

• $60 if filed 31 days to 6 months after the

seller/transferor on Form 593, on the principal

seller/transferor must file a California tax return

due date.

portion of each installment payment. The

and report the entire sale on Schedule D-1,

• $100 if filed more than 6 months after the

seller’s/transferor’s signature is not required

Sale of Business Property. After filing the

due date.

on each subsequent and completed Form 593.

tax return and reporting the entire gain, the

I

(R&TC Section 19183)

Do not include another completed Form 593-

seller/transferor must submit a written request

and a copy of the promissory note. Mail each

If the failure is due to an intentional disregard

to the Franchise Tax Board (FTB) to release

withholding payment with Form 593-V, and

of the requirement, the penalty is the greater

the buyer/transferee from withholding on the

use a completed current year Form 593. Use

of $250 or 10% of the required withholding.

installment sale payments. Once the request

the taxable year Form 593 for which you are

Penalties referenced in this section will be

is received, the FTB will issue an approval or

sending the withholding payment. Do not use

assessed unless it is shown that the failure to

denial within 30 days.

the copy of Form 593 provided to you during

notify, withhold, or timely furnish returns was

Registered Domestic Partners (RDP) – For

escrow.

due to reasonable cause.

purposes of California income tax, references

When the buyer/transferee sends the

to a spouse, husband, or wife also refer to a

withholding on the final installment payment,

California RDP, unless otherwise specified.

write “Final Installment Payment” on the

When we use the initials RDP they refer to both

bottom of Form 593.

a California registered domestic “partner” and

For more information on withholding on

a California registered domestic “partnership,”

installment payments, get the instructions for

as applicable. For more information on

Form 593 or call Withholding Services and

RDPs, get FTB Pub. 737, Tax Information for

Compliance at 888.792.4900 or 916.845.4900.

Registered Domestic Partners.

I

Form 593-

Instructions 2015 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4