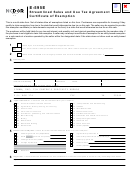

Streamlined Sales and Use Tax Agreement - New Jersey

Certificate of Exemption Instructions

Use this form to claim exemption from sales tax on purchases of otherwise taxable items. The

purchaser must complete all fields on the exemption certificate and provide the fully completed

certificate to the seller in order to claim exemption.

Warning to purchaser: You are responsible for ensuring that you are eligible for the exemption you

are claiming. You will be held liable for any tax and interest, and possibly penalties imposed by the

member state due the tax on your purchase, if the purchase is not legally exempt.

Purchaser instructions for completing the exemption certificate

1. Some purchasers may wish to complete a single certificate for multiple states where

they conduct business and, regularly, make exempt purchases from the same seller.

If you do, check the box on the front of the SSUTA Certificate of Exemption to

indicate that you are attaching the Multistate Supplemental form.

CAUTION: Certificates completed with a multistate supplement may include non-

member states of the SST Governing Board, provided those states have agreed to

accept the SSUTA Certificate of Exemption. Both sellers and purchasers MUST BE

AWARE that these additional non-member states may not have adopted the SSUTA

provisions for Multiple Points of Use and Direct Mail. Additionally, completion of this

certificate in its entirety may not fully relieve the seller from liability unless non-

member states’ requirements have been met.

If you are not attaching the Multistate Supplemental form, enter the two-letter postal

abbreviation for the state under whose laws you are claiming exemption. For

example, if you are claiming an exemption from sales or use tax imposed by the

state of Minnesota, enter “MN” in the boxes provided. If you are claiming exemption

for more than one member state, complete the SSUTA Certificate of Exemption:

Multistate Supplemental form.

2. Single purchase exemption certificate: Check this box if this exemption certificate

is being used for a single purchase. Include the invoice or purchase order number

for the transaction.

If this box is not checked, this certificate will be treated as a blanket certificate. A

blanket certificate continues in force so long as the purchaser is making recurring

purchases (at least one purchase within a period of twelve consecutive months) or

until otherwise cancelled by the purchaser.

3. Purchaser information: Complete the purchaser and seller information section, as

requested. An identification number for you or your business must be included.

Include your state tax identification number and identify the state and/or country that

issued the number to you. If you do not have a state tax identification number, enter

1

1 2

2 3

3 4

4 5

5