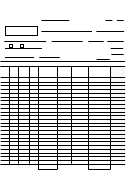

BOE-560-B (S2F) REV. 6 (8-06)

INSTRUCTIONS FOR COMPLETING MINING PRODUCTION REPORT

If this report is prepared prior to January 1, any change in real property between the date the report is prepared and January 1 must be reported

to the Assessor on a supplemental report.

All personal property, excluding stockpiles, owned by the respondent and any property belonging to others at this location as of January 1 must

be reported to the Assessor on a Business Property Statement form.

A separate production report must be filed for each location and/or operation. A single report may cover several leases or parcels if all have the

same geological characteristics and are operated as a unit.

Maps or aerial photos should be submitted for every year in which changes have occurred in the development of the property. Attach a map to

describe and locate the property clearly. Include a plot plan that shows pit site, railroad spur lines, plant site, location of reserves, etc.

Line numbers listed in these instructions refer to identical line numbers printed on the form. At top of form fill in the year of the lien date for which

this report is made.

LINE 1.

NAME AND MAILING ADDRESS

a. NAME

If the name is preprinted, check the spelling and correct any error. In the case of an individual, enter the last name first, then the first

name and middle initial. Partnerships must enter at least two names, showing the last name, first name and middle initial for each

partner. Corporation names should be complete so they will not be confused with fictitious or DBA (Doing Business As) names.

b. DBA OR FICTITIOUS NAME

Enter the DBA name under which you are operating in this county below the name of the sole owner, partnership or corporation.

c. MAILING ADDRESS

Enter the mailing address of the legal entity shown in line 1b above. This may be either a street address or a post office box number.

It may differ from the actual location of the property. Include the city, state and ZIP code.

LINE 2.

LOCATION OF ThE PROPERTY

Fill in the mine or quarry name and the section, township and range in which the mine or quarry is located.

LINE 3.

PARCEL NUMBER

List the parcel number and tax rate area number, if known. Give legal description only if parcel number is not used. Also give legal

description for any year in which there has been a change in lease boundaries.

LINE 4.

PhONE NUMBER

Enter the phone number where we may contact you or your authorized representative for information regarding the subject property.

LINE 5a.

COMMENTS ON “MINE OPERATION STATEMENT”

a. If a mine is not producing, make the notation “No Production” on the “Mining Operation Statement. ”

b. Ore refers to whatever rock or mineral commodity is produced for sale or processing and includes talc, etc. as well as metallic and

other true ores. Gold production, for example, would be reported in ounces. Gold reserves, however, should be reported as tons of

reserves of “xx” grade. See (e) below for the definition of reserves to be reported on this line.

c. If the ore is not sold, but is processed or milled by you or someone else, also complete Section 5b. In that case it is not necessary

to complete “Sales Volume, ” “Gross Income, ” or “Price. ” If royalty is paid on the basis of ore produced, complete “Royalty Paid. ” “Sales

Volume” means volume sold and/or volume retained by owners or producers in the form of a valuable commodity.

d. Gross Income is income before deducting royalty payments.

e. Reserve definitions:

Mineable reserves means those reserves in a mineral deposit for which extraction of the ore or mineral is economically feasible.

Proved reserves means those minerals measured by volume or weight which geological and engineering information indicate with

reasonable certainty to be recoverable in the future, taking into account reasonably projected physical and economic operating

conditions. Proved reserves include all minerals which satisfy the conditions of the preceding sentence without regard to how the

term is used in the industry.

Note: Reserves, for property tax purposes, do not include stockpiled ore. (For property tax purposes, ore, once severed from the land,

is no longer real property.)

Grade refers to the undiluted percentage of mineral content in the ore.

Ore is defined as a mineral or group of minerals of sufficient value as to quality and quantity which may be mined with profit. If the

definitions described here are not the same as those used by you, attach a copy of the ones you use for reporting your reserves in

this Section (5a).

LINE 5b.

COMMENT ON “PROCESSING OR MILLING OPERATION STATEMENT”

The name of the product milled or processed is the name given to the marketed product at the first stage in processing at which it

is sold. Sales Volume means volume sold and/or volume retained by owners or producers in the form of a valuable commodity.

LINE 5c.

COMMENTS ON “OPERATING COST STATEMENT”

If this section is not adequate for detail necessary, attach a schedule which provides the detail.

1

1 2

2 3

3 4

4