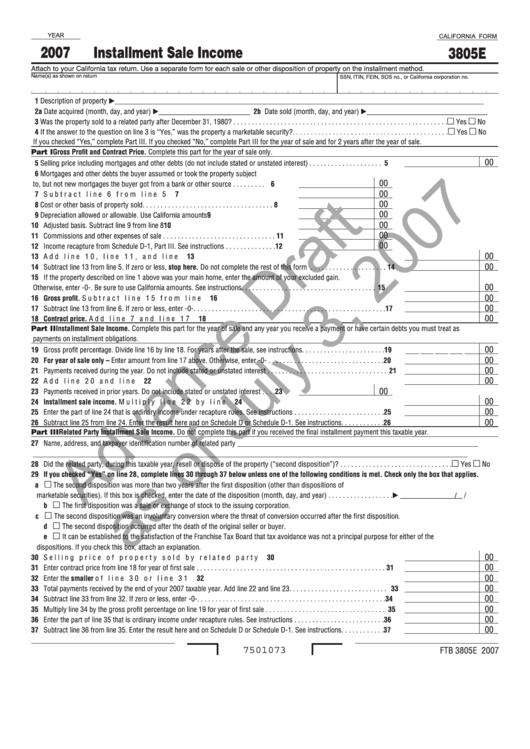

California Form 3805e Advance Draft - Installment Sale Income - 2007

ADVERTISEMENT

YEAR

CALIFORNIA FORM

2007

Installment Sale Income

3805E

Attach to your California tax return. Use a separate form for each sale or other disposition of property on the installment method.

Name(s) as shown on return

SSN, ITIN, FEIN, SOS no., or California corporation no.

1 Description of property _____________________________________________________________________________________________________

2a Date acquired (month, day, and year) _________________________ 2b Date sold (month, day, and year) _________________________________

3 Was the property sold to a related party after December 31, 1980? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

4 If the answer to the question on line 3 is “Yes,” was the property a marketable security? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If you checked “Yes,” complete Part III . If you checked “No,” complete Part III for the year of sale and for 2 years after the year of sale .

Part I Gross Profit and Contract Price. Complete this part for the year of sale only .

00

5 Selling price including mortgages and other debts (do not include stated or unstated interest) . . . . . . . . . . . . . . . . . . . .

5

6 Mortgages and other debts the buyer assumed or took the property subject

00

to, but not new mortgages the buyer got from a bank or other source . . . . . . . . .

6

00

7 Subtract line 6 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8 Cost or other basis of property sold . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

9 Depreciation allowed or allowable . Use California amounts . . . . . . . . . . . . . . . . . .

9

00

10 Adjusted basis . Subtract line 9 from line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

00

11 Commissions and other expenses of sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

00

12 Income recapture from Schedule D-1, Part III . See instructions . . . . . . . . . . . . . . 12

00

13 Add line 10, line 11, and line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

00

14 Subtract line 13 from line 5 . If zero or less, stop here. Do not complete the rest of this form . . . . . . . . . . . . . . . . . . . . . 14

15 If the property described on line 1 above was your main home, enter the amount of your excluded gain .

00

Otherwise, enter -0- . Be sure to use California amounts . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

00

16 Gross profit. Subtract line 15 from line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

00

17 Subtract line 13 from line 6 . If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

00

18 Contract price. Add line 7 and line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

Part II Installment Sale Income. Complete this part for the year of sale and any year you receive a payment or have certain debts you must treat as

payments on installment obligations .

00

19 Gross profit percentage . Divide line 16 by line 18 . For years after the sale, see instructions . . . . . . . . . . . . . . . . . . . . . . . 19

00

20 For year of sale only – Enter amount from line 17 above . Otherwise, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

00

21 Payments received during the year . Do not include stated or unstated interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

00

22 Add line 20 and line 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

00

23 Payments received in prior years . Do not include stated or unstated interest . . . . 23

00

24 Installment sale income. Multiply line 22 by line 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

00

25 Enter the part of line 24 that is ordinary income under recapture rules . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . 25

00

26 Subtract line 25 from line 24 . Enter the result here and on Schedule D or Schedule D-1 . See instructions . . . . . . . . . . . . 26

Part III Related Party Installment Sale Income. Do not complete this part if you received the final installment payment this taxable year .

27 Name, address, and taxpayer identification number of related party __________________________________________________________________

_______________________________________________________________________________________________________________________

28 Did the related party, during this taxable year, resell or dispose of the property (“second disposition”)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

29 If you checked “Yes” on line 28, complete lines 30 through 37 below unless one of the following conditions is met. Check only the box that applies.

a

The second disposition was more than two years after the first disposition (other than dispositions of

marketable securities) . If this box is checked, enter the date of the disposition (month, day, and year) . . . . . . . . . . . . . . . . . . _________________

/

/

b

The first disposition was a sale or exchange of stock to the issuing corporation .

c

The second disposition was an involuntary conversion where the threat of conversion occurred after the first disposition .

d

The second disposition occurred after the death of the original seller or buyer .

e

It can be established to the satisfaction of the Franchise Tax Board that tax avoidance was not a principal purpose for either of the

dispositions . If you check this box, attach an explanation .

00

30 Selling price of property sold by related party . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

00

31 Enter contract price from line 18 for year of first sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

00

32 Enter the smaller of line 30 or line 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

00

33 Total payments received by the end of your 2007 taxable year . Add line 22 and line 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

00

34 Subtract line 33 from line 32 . If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

00

35 Multiply line 34 by the gross profit percentage on line 19 for year of first sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

00

36 Enter the part of line 35 that is ordinary income under recapture rules . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . 36

00

37 Subtract line 36 from line 35 . Enter the result here and on Schedule D or Schedule D-1 . See instructions . . . . . . . . . . . . 37

7501073

FTB 3805E 2007

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1