Instructions For Completion Of Refund Claim Form Ar1000ptr

ADVERTISEMENT

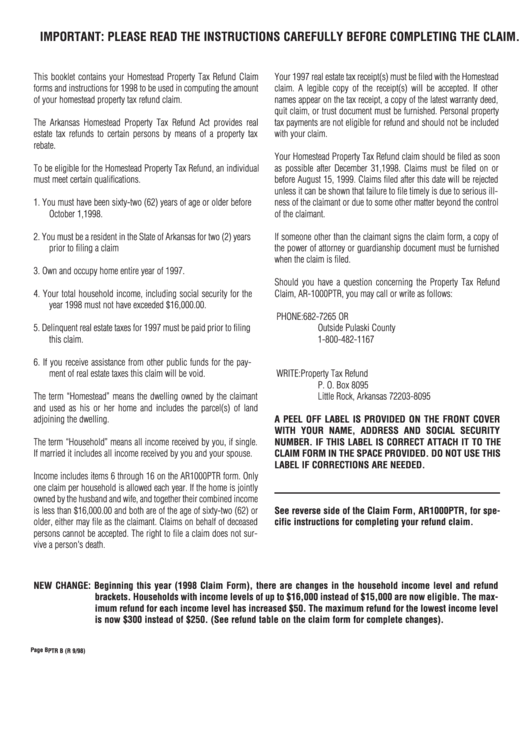

IMPORTANT: PLEASE READ THE INSTRUCTIONS CAREFULLY BEFORE COMPLETING THE CLAIM.

This booklet contains your Homestead Property Tax Refund Claim

Your 1997 real estate tax receipt(s) must be filed with the Homestead

forms and instructions for 1998 to be used in computing the amount

claim. A legible copy of the receipt(s) will be accepted. If other

of your homestead property tax refund claim.

names appear on the tax receipt, a copy of the latest warranty deed,

quit claim, or trust document must be furnished. Personal property

The Arkansas Homestead Property Tax Refund Act provides real

tax payments are not eligible for refund and should not be included

estate tax refunds to certain persons by means of a property tax

with your claim.

rebate.

Your Homestead Property Tax Refund claim should be filed as soon

To be eligible for the Homestead Property Tax Refund, an individual

as possible after December 31,1998. Claims must be filed on or

must meet certain qualifications.

before August 15, 1999. Claims filed after this date will be rejected

unless it can be shown that failure to file timely is due to serious ill-

1. You must have been sixty-two (62) years of age or older before

ness of the claimant or due to some other matter beyond the control

October 1,1998.

of the claimant.

2. You must be a resident in the State of Arkansas for two (2) years

If someone other than the claimant signs the claim form, a copy of

prior to filing a claim

the power of attorney or guardianship document must be furnished

when the claim is filed.

3. Own and occupy home entire year of 1997.

Should you have a question concerning the Property Tax Refund

4. Your total household income, including social security for the

Claim, AR-1000PTR, you may call or write as follows:

year 1998 must not have exceeded $16,000.00.

PHONE:

682-7265 OR

5. Delinquent real estate taxes for 1997 must be paid prior to filing

Outside Pulaski County

this claim.

1-800-482-1167

6. If you receive assistance from other public funds for the pay-

ment of real estate taxes this claim will be void.

WRITE:

Property Tax Refund

P. O. Box 8095

The term “Homestead” means the dwelling owned by the claimant

Little Rock, Arkansas 72203-8095

and used as his or her home and includes the parcel(s) of land

adjoining the dwelling.

A PEEL OFF LABEL IS PROVIDED ON THE FRONT COVER

WITH YOUR NAME, ADDRESS AND SOCIAL SECURITY

The term “Household” means all income received by you, if single.

NUMBER. IF THIS LABEL IS CORRECT ATTACH IT TO THE

If married it includes all income received by you and your spouse.

CLAIM FORM IN THE SPACE PROVIDED. DO NOT USE THIS

LABEL IF CORRECTIONS ARE NEEDED.

Income includes items 6 through 16 on the AR1000PTR form. Only

one claim per household is allowed each year. If the home is jointly

owned by the husband and wife, and together their combined income

is less than $16,000.00 and both are of the age of sixty-two (62) or

See reverse side of the Claim Form, AR1000PTR, for spe-

older, either may file as the claimant. Claims on behalf of deceased

cific instructions for completing your refund claim.

persons cannot be accepted. The right to file a claim does not sur-

vive a person's death.

NEW CHANGE: Beginning this year (1998 Claim Form), there are changes in the household income level and refund

brackets. Households with income levels of up to $16,000 instead of $15,000 are now eligible. The max-

imum refund for each income level has increased $50. The maximum refund for the lowest income level

is now $300 instead of $250. (See refund table on the claim form for complete changes).

Page B

PTR B (R 9/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2