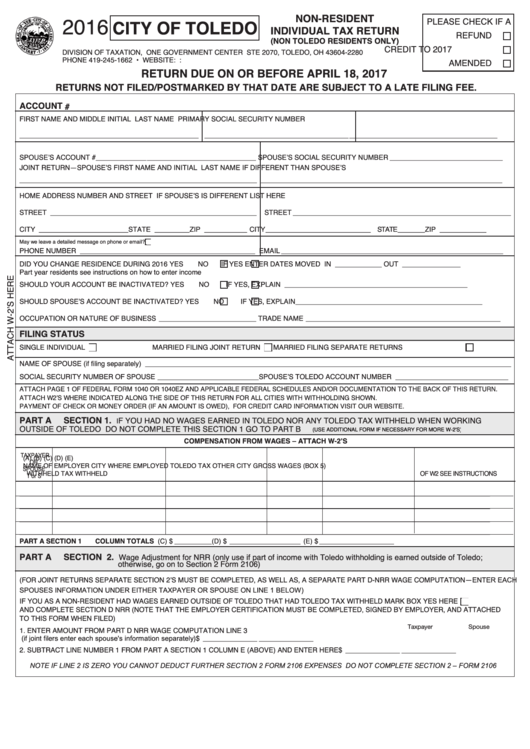

Non-Resident Individual Tax Return - City Of Toledo - 2016

ADVERTISEMENT

NON-RESIDENT

2016

CITY OF TOLEDO

PLEASE CHECK IF A

INDIVIDUAL TAX RETURN

REFUND

(NON TOLEDO RESIDENTS ONLY)

CREDIT TO 2017

DIVISION OF TAXATION, ONE GOVERNMENT CENTER STE 2070, TOLEDO, OH 43604-2280

PHONE 419-245-1662 • WEBSITE: EMAIL: INCOMETAX@TOLEDO.OH.GOV

AMENDED

RETURN DUE ON OR BEFORE APRIL 18, 2017

RETURNS NOT FILED/POSTMARKED BY THAT DATE ARE SUBJECT TO A LATE FILING FEE.

ACCOUNT #

FIRST NAME AND MIDDLE INITIAL

LAST NAME

PRIMARY SOCIAL SECURITY NUMBER

______________________________________________

_____________________________________

______________________________________

SPOUSE’S ACCOUNT #_____________ ____________________________

SPOUSE’S SOCIAL SECURITY NUMBER _____________________________

JOINT RETURN—SPOUSE’S FIRST NAME AND INITIAL

LAST NAME IF DIFFERENT THAN SPOUSE’S

_____________________________________________________________

______________________________________________________________

HOME ADDRESS NUMBER AND STREET

IF SPOUSE’S IS DIFFERENT LIST HERE

STREET _____________________________________________________

STREET ________________________________________________________

CITY _______________________ STATE _________ ZIP ___________

CITY ___________________________

STATE _______ ZIP ____________

May we leave a detailed message on phone or email?

PHONE NUMBER _____________________________________________

EMAIL _________________________________________________________

DID YOU CHANGE RESIDENCE DURING 2016

YES

NO

IF YES ENTER DATES MOVED IN ____________ OUT _______________

Part year residents see instructions on how to enter income

SHOULD YOUR ACCOUNT BE INACTIVATED?

YES

NO

IF YES, EXPLAIN _______________________________________________

SHOULD SPOUSE’S ACCOUNT BE INACTIVATED?

YES

NO

IF YES, EXPLAIN ________________________________________________

OCCUPATION OR NATURE OF BUSINESS _________________________

TRADE NAME __________________________________________________

FILING STATUS

SINGLE INDIVIDUAL

MARRIED FILING JOINT RETURN

MARRIED FILING SEPARATE RETURNS

NAME OF SPOUSE (if filing separately) ______________________________________________________________________________________________

SOCIAL SECURITY NUMBER OF SPOUSE __________________________ SPOUSE’S TOLEDO ACCOUNT NUMBER _____________________________

ATTACH PAGE 1 OF FEDERAL FORM 1040 OR 1040EZ AND APPLICABLE FEDERAL SCHEDULES AND/OR DOCUMENTATION TO THE BACK OF THIS RETURN.

ATTACH W2’S WHERE INDICATED ALONG THE SIDE OF THIS RETURN FOR ALL CITIES WITH WITHHOLDING SHOWN.

PAYMENT OF CHECK OR MONEY ORDER (IF AN AMOUNT IS OWED), FOR CREDIT CARD INFORMATION VISIT OUR WEBSITE.

PART A

SECTION 1.

F YOU HAD NO WAGES EARNED IN TOLEDO NOR ANY TOLEDO TAX WITHHELD WHEN WORKING

I

OUTSIDE OF TOLEDO DO NOT COMPLETE THIS SECTION 1 GO TO PART B

(USE ADDITIONAL FORM IF NECESSARY FOR MORE W-2'S)

COMPENSATION FROM WAGES – ATTACH W-2’S

TAXPAYER

(A)

(B)

(C)

(D)

(E)

OR

NAME OF EMPLOYER

CITY WHERE EMPLOYED

TOLEDO TAX

OTHER CITY

GROSS WAGES (BOX 5)

SPOUSE

WITHHELD

TAX WITHHELD

OF W2 SEE INSTRUCTIONS

T or S

______________________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________

. PART A SECTION 1

COLUMN TOTALS ..........................................................(C) $ __________ (D) $ ___________________ (E) $ ____________________

PART A

SECTION 2.

Wage Adjustment for NRR (only use if part of income with Toledo withholding is earned outside of Toledo;

otherwise, go on to Section 2 Form 2106)

(FOR JOINT RETURNS SEPARATE SECTION 2’S MUST BE COMPLETED, AS WELL AS, A SEPARATE PART D-NRR WAGE COMPUTATION—ENTER EACH

SPOUSES INFORMATION UNDER EITHER TAXPAYER OR SPOUSE ON LINE 1 BELOW)

IF YOU AS A NON-RESIDENT HAD WAGES EARNED OUTSIDE OF TOLEDO THAT HAD TOLEDO TAX WITHHELD MARK BOX YES HERE

AND COMPLETE SECTION D NRR (NOTE THAT THE EMPLOYER CERTIFICATION MUST BE COMPLETED, SIGNED BY EMPLOYER, AND ATTACHED

TO THIS FORM WHEN FILED)

Taxpayer

Spouse

1. ENTER AMOUNT FROM PART D NRR WAGE COMPUTATION LINE 3

(if joint filers enter each spouse's information separately) .............................................................................................. $ ______________

______________

2. SUBTRACT LINE NUMBER 1 FROM PART A SECTION 1 COLUMN E (ABOVE) AND ENTER HERE ....................... $ ______________

______________

NOTE IF LINE 2 IS ZERO YOU CANNOT DEDUCT FURTHER SECTION 2 FORM 2106 EXPENSES DO NOT COMPLETE SECTION 2 – FORM 2106

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4