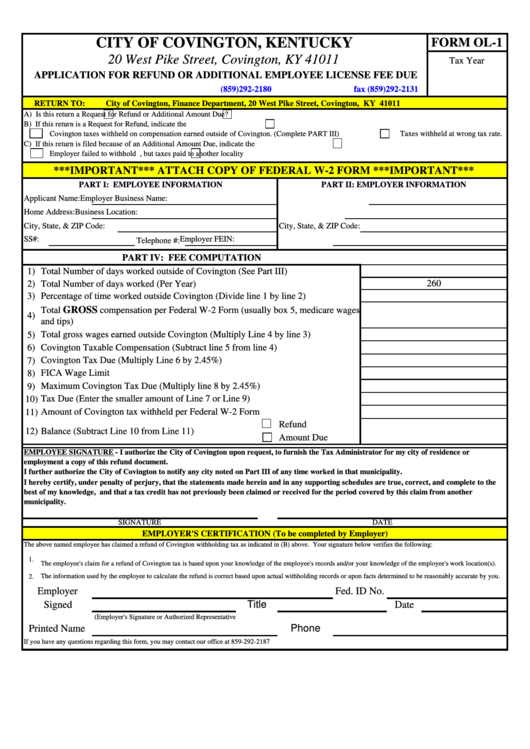

Form Ol-1 - Application For Refund Or Additional Employee License Fee Due - City Of Covington

ADVERTISEMENT

CITY OF COVINGTON, KENTUCKY

FORM OL-1

20 West Pike Street, Covington, KY 41011

Tax Year

APPLICATION FOR REFUND OR ADDITIONAL EMPLOYEE LICENSE FEE DUE

(859)292-2180

fax (859)292-2131

RETURN TO:

City of Covington, Finance Department, 20 West Pike Street, Covington, KY 41011

A) Is this return a

Request for Refund or

Additional Amount Due?

B) If this return is a Request for Refund, indicate the reason.

Taxes withheld on compensation over the maximum limit.

Covington taxes withheld on compensation earned outside of Covington. (Complete PART III)

Taxes withheld at wrong tax rate.

C) If this return is filed because of an Additional Amount Due, indicate the reason.

Taxes withheld at wrong tax rate.

Employer failed to withhold taxes.

Compensation earned within Covington, but taxes paid to another locality

***IMPORTANT*** ATTACH COPY OF FEDERAL W-2 FORM ***IMPORTANT***

PART I: EMPLOYEE INFORMATION

PART II: EMPLOYER INFORMATION

Applicant Name:

Employer Business Name:

Home Address:

Business Location:

City, State, & ZIP Code:

City, State, & ZIP Code:

SS#:

Employer FEIN:

Telephone #:

PART IV: FEE COMPUTATION

1)

Total Number of days worked outside of Covington (See Part III)

260

2)

Total Number of days worked (Per Year)

Percentage of time worked outside Covington (Divide line 1 by line 2)

3)

GROSS

Total

compensation per Federal W-2 Form (usually box 5, medicare wages

4)

and tips)

5)

Total gross wages earned outside Covington (Multiply Line 4 by line 3)

6)

Covington Taxable Compensation (Subtract line 5 from line 4)

Covington Tax Due (Multiply Line 6 by 2.45%)

7)

FICA Wage Limit

8)

Maximum Covington Tax Due (Multiply line 8 by 2.45%)

9)

Tax Due (Enter the smaller amount of Line 7 or Line 9)

10)

Amount of Covington tax withheld per Federal W-2 Form

11)

Refund

12)

Balance (Subtract Line 10 from Line 11)

Amount Due

EMPLOYEE SIGNATURE - I authorize the City of Covington upon request, to furnish the Tax Administrator for my city of residence or

employment a copy of this refund document.

I further authorize the City of Covington to notify any city noted on Part III of any time worked in that municipality.

I hereby certify, under penalty of perjury, that the statements made herein and in any supporting schedules are true, correct, and complete to the

best of my knowledge, and that a tax credit has not previously been claimed or received for the period covered by this claim from another

municipality.

SIGNATURE

DATE

EMPLOYER'S CERTIFICATION (To be completed by Employer)

The above named employee has claimed a refund of Covington withholding tax as indicated in (B) above. Your signature below verifies the following:

1.

The employee's claim for a refund of Covington tax is based upon your knowledge of the employee's records and/or your knowledge of the employee's work location(s).

The information used by the employee to calculate the refund is correct based upon actual withholding records or upon facts determined to be reasonably accurate by you.

2.

Employer

Fed. ID No.

Title

Signed

Date

(Employer's Signature or Authorized Representative)

Phone

Printed Name

If you have any questions regarding this form, you may contact our office at 859-292-2187

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2