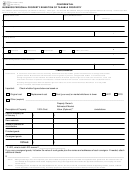

P r o p e r t y T a x

B u s i n e s s P e r s o n a l P r o p e r t y R e n d i t i o n o f T a x a b l e P r o p e r t y

Form 50-144

_____________________________________________________________________

___________________________

Appraisal District’s Property Identification Number (if known)

Tax Year

___________________________________________________________________________________________________

Property Owner’s Name

___________________________________________________________________________________________________

Present Mailing Address

_____________________________________________________________________

___________________________

City, State, ZIP Code

Phone (area code and number)

Please indicate if you are filling out this form as:

Authorized Agent

Fiduciary

Secured Party

___________________________________________________________________________________________________

Name of Authorized Agent, Fiduciary, or Secured Party

___________________________________________________________________________________________________

Present Mailing Address

_____________________________________________________________________

___________________________

City, State, ZIP Code

Phone (area code and number)

________

By checking this box, I affirm that the information contained in the most recent rendition statement filed for a prior tax year (the

tax year)

continues to be complete and accurate for the current tax year.

Check the total market value of your property.

Under $20,000

$20,000 or more

If you checked “Under $20,000,” please complete only Schedule A. Otherwise, complete Schedule B and/or C, whichever is applicable.

When required by the chief appraiser, you must render any taxable property that you own or manage and control as a fiduciary on January 1 [Tax Code

Section 22.01(b)]. For this type of property, complete Schedule A, B, and/or C, whichever is applicable.

When required by the chief appraiser, you must file a report listing the name and address of each owner of property that is in your possession or under

your management on January 1 by bailment, lease, consignment, or other arrangement [Tax Code Section 22.04(a)]. For this type of property, complete

Schedule D.

Are you the property owner, an employee of the property owner, or an employee of a property owner on behalf of an affiliated

entity of the property owner? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Are you a secured party with a security interest in the property subject to this rendition and with a historical cost new of more

than $50,000, as defined and required by Tax Code Section 22.01(c-1) and (c-2)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If you checked “Yes” to this question, you must attach a document signed by the property owner indicating consent for you to file the rendition. Without

the authorization, the rendition is not valid and cannot be processed.

For more information, visit our website:

Page 2 • 50-144 • 08-13/15

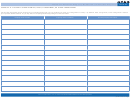

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8