Internet Filing Instructions - Quarterly Contribution And Wage Report

ADVERTISEMENT

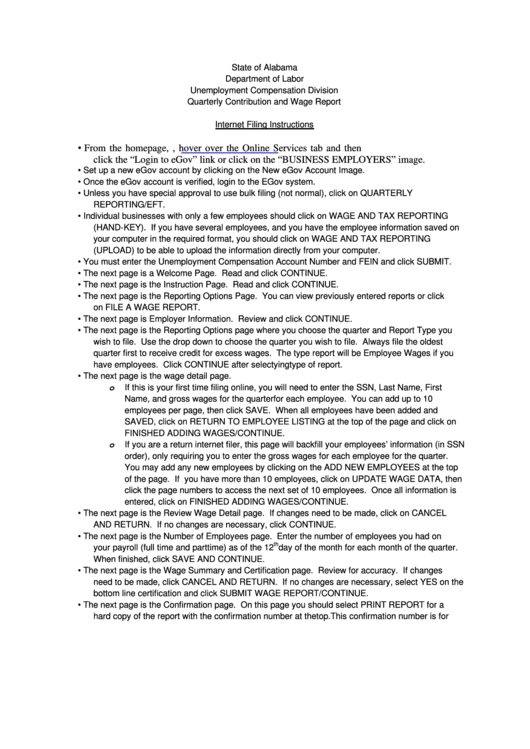

State of Alabama

Department of Labor

Unemployment Compensation Division

Quarterly Contribution and Wage Report

Internet Filing Instructions

•

From the homepage, , hover over the Online Services tab and then

click the “Login to eGov” link or click on the “BUSINESS EMPLOYERS” image.

•

Set up a new eGov account by clicking on the New eGov Account Image.

•

Once the eGov account is verified, login to the EGov system.

•

Unless you have special approval to use bulk filing (not normal), click on QUARTERLY

REPORTING/EFT.

•

Individual businesses with only a few employees should click on WAGE AND TAX REPORTING

(HAND-KEY). If you have several employees, and you have the employee information saved on

your computer in the required format, you should click on WAGE AND TAX REPORTING

(UPLOAD) to be able to upload the information directly from your computer.

•

You must enter the Unemployment Compensation Account Number and FEIN and click SUBMIT.

•

The next page is a Welcome Page. Read and click CONTINUE.

•

The next page is the Instruction Page. Read and click CONTINUE.

•

The next page is the Reporting Options Page. You can view previously entered reports or click

on FILE A WAGE REPORT.

•

The next page is Employer Information. Review and click CONTINUE.

•

The next page is the Reporting Options page where you choose the quarter and Report Type you

wish to file. Use the drop down to choose the quarter you wish to file. Always file the oldest

quarter first to receive credit for excess wages. The type report will be Employee Wages if you

have employees. Click CONTINUE after selectying type of report.

•

The next page is the wage detail page.

If this is your first time filing online, you will need to enter the SSN, Last Name, First

o

Name, and gross wages for the quarter for each employee. You can add up to 10

employees per page, then click SAVE. When all employees have been added and

SAVED, click on RETURN TO EMPLOYEE LISTING at the top of the page and click on

FINISHED ADDING WAGES/CONTINUE.

If you are a return internet filer, this page will backfill your employees’ information (in SSN

o

order), only requiring you to enter the gross wages for each employee for the quarter.

You may add any new employees by clicking on the ADD NEW EMPLOYEES at the top

of the page. If you have more than 10 employees, click on UPDATE WAGE DATA, then

click the page numbers to access the next set of 10 employees. Once all information is

entered, click on FINISHED ADDING WAGES/CONTINUE.

•

The next page is the Review Wage Detail page. If changes need to be made, click on CANCEL

AND RETURN. If no changes are necessary, click CONTINUE.

•

The next page is the Number of Employees page. Enter the number of employees you had on

th

your payroll (full time and part time) as of the 12

day of the month for each month of the quarter.

When finished, click SAVE AND CONTINUE.

•

The next page is the Wage Summary and Certification page. Review for accuracy. If changes

need to be made, click CANCEL AND RETURN. If no changes are necessary, select YES on the

bottom line certification and click SUBMIT WAGE REPORT/CONTINUE.

•

The next page is the Confirmation page. On this page you should select PRINT REPORT for a

hard copy of the report with the confirmation number at the top. This confirmation number is for

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2