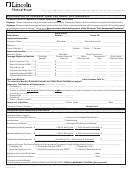

policy/certificate number(s) ___________________________________________________________________________________

trust -

Please furnish the trust’s tax identification number. The decedent’s Social Security Number should not be used.

Lincoln Financial recommends that before completing this form, the Trustee consult with legal and/or tax advisors that are not only

familiar with the terms of the Trust, but also the requirements and provisions of the generation skipping transfer taxes imposed by the

Internal Revenue Code. This declaration may be completed by either the Trustee or an attorney that represents the Trust. The person

signing this declaration on behalf of the Trust should understand that Lincoln Financial is relying on this declaration in complying with

the generation skipping transfer tax withholding and reporting rules.

Name of Trust: ___________________________________________________________

Date of Trust: ______________________

Printed Name of Trustee: ___________________________________________________

Trust Tax ID Number: ______________________________________

if this declaration is completed By an attorney representing the trust, please print name and address:

Name: ______________________________________________________________________________________________________

Address: ____________________________________________________________________________________________________

The Internal Revenue Code imposes a Generation Skipping Transfer (“GST”) tax on transfers of property to individuals that are two or

more generation below the generation of the individual making the transfer. The GST applies to both lifetime transfer and transfer at

death. The GST applies to direct gifts as well as gifts to trusts. The GST rules are very complex, and if you are not familiar with them,

you should seek out and rely upon the advice of your attorney or other advisor before completing this Declaration.

The IRS requires Lincoln Financial to report and collect the GST tax on any life insurance death benefit of $250,000 or more. In order for

Lincoln Financial to know if GST taxes should be withheld from the death benefits, we need this Declaration completed and returned to us.

- The undersigned certifies that the above identified Trust is not a generation skipping transfer trust.

(Check this box , if for example, the only beneficiaries of the trust are the children of the insured. This box would also be appropriate if a grandchild

is a beneficiary only because his or her parent (the insured’s child) has died.)

- The undersigned certifies that although the trust is a generation skipping transfer trust, the payment of the life insurance or annuity

death proceeds is (i) excluded from the definition of a generation skipping transfer by IRC §2611(b) or (ii) is otherwise not subject to

current generation skipping transfer taxes (e.g., the insured had no incidents of ownership in the policy at the time of his or her death).

(Check this box if, for example, the insured established, while living, an irrevocable life insurance trust for the benefit of his children and

grandchildren, and the assets in that trust are not included in the insured’s taxable estate under IRS rules. Even if the only beneficiaries are the

insured’s grandchildren, if the insured has no “incidence of ownership” in the trust, the GST tax will not apply at the time Lincoln Financial pays

the life insurance death benefit. In some cases, the insured may have been required to report and pay GST taxes (or allocate part of his or her lifetime

exemption to the contributions) on prior gifts to the trust. There are numerous special estate tax rules that should be considered, including the rule

that transfers of property within three years of the date of death can result in the transferred property being included in the individual’s estate.)

- The undersigned certifies that the above identified Trust is a generation skipping transfer trust as that term is defined and used in the

Internal Revenue Code. Attached to this statement is a true and correct copy of an allocation of all or a portion of the generation skipping

transfer tax exemption (Schedule R-1 to IRS Form 706) to this Trust.

(Check this box if the payment of the death benefit is subject to the GST tax, but you wish to allocate all or a portion of the GST tax exemption to this

policy. Lincoln Financial must receive a completed Schedule R-1 before any amount can be allocated to the policy death benefit. If the allocation

is for less than the policy proceeds, Lincoln Financial will withhold GST taxes on the balance.)

- The undersigned certifies that the above identified Trust is a generation skipping transfer trust as that term is defined and used in the Internal

Revenue Code and that the Trust has an inclusion ratio of one (i.e., there is no exemption remaining to be allocated to this Trust). If this box is

checked, Lincoln Financial will withhold generation skipping transfer taxes from the payment at the amount required by law. (

Check this box if

the entire amount of the death benefit is subject to the GST tax. Lincoln Financial will withhold at the applicable rate on the entire amount.)

By signing this declaration on behalf of the Trust, the undersigned represents (1) that a full and complete inquiry as to the facts has

been made, (2) that this declaration is true and correct to the best of my knowledge and belief, and (3) that this declaration is made

with the specific knowledge that Lincoln Financial will rely on this statement in tax reporting.

Trustee Signature: _________________________________________________________

Date: _____________________________

SWORN TO AND SUBSCRIBED before me, this _______ day of _______________________, 20_____.

Notary Public:___________________________________________ My Commission Expires: _______________________________

Page 2 of 4

CL05984

9/13

1

1 2

2 3

3 4

4