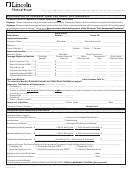

4. FEDERAL/STATE INCOME TAX WITHHOLDING

If tax information is not provided, federal income tax in the amount of 10% and applicable state income tax will be withheld.

Once your withholding election is made, it will remain in effect unless the Company is notified of a change. You may change your

election at anytime. If you elect not to have tax withheld, you will remain liable for payment of federal income tax on your distribution.

You may also be subject to tax penalties under the estimated tax payment rules if your payment of estimated tax and withholding, if any,

are not adequate. You may wish to discuss your withholding election with a qualified tax advisor.

Federal income tax withholding options:

(Select One)

h Do not withhold federal income tax

h Withhold 10% federal income tax

h Indicate the dollar amount or total percentage of federal income tax to be withheld.

$ ____________ or

_____ %

(The amount must be greater than 10%.)

If federal income tax is withheld, state income tax may be withheld, depending on your state of residence. The following states mandate

state income tax withholding if federal income tax is withheld: Arkansas, California, Georgia, Iowa, Maine, Massachusetts,

Nebraska, North Carolina, Oklahoma, Oregon, Vermont and Virginia.

Residents of Arkansas, Georgia, California, North Carolina or Oregon may elect not to withhold state income tax.

State income tax withholding options:

(Select One)

h As a resident of Arkansas, Georgia, California, North Carolina or Oregon, I elect not to withhold state income tax from my distribution.

State of residence ________________________________

(Michigan residents MUST elect state income tax withholding on form MI W-4P.)

h Do not withhold state income tax

(Opt Out)

h Voluntary state income tax amount $ _____________ or

_____%

Note: The dollar or percentage amount withheld must meet the minimum withholding guidelines for your state.

5. DISTRIBUTION INFORMATION

h Direct Deposit

h Wire

(No Fee)

($25 fee for domestic wires; $40 fee for foreign wires)

Financial Institution’s Name __________________________________________________________________________________

Financial Institution’s Address ________________________________________________________________________________

Financial Institution’s Telephone Number _______________________________________________________________________

Type of Account:

h Checking

(must attach a “voided” check)

h Savings

(must attach a deposit slip)

h Brokerage Account

***

Account Number _________________________________ Transit/Routing Number _____________________________________

Note: The transit/routing number should be obtained from the financial institution.

Note: A CHECK WILL BE SENT IN THE FOLLOWING CASES: Not all brokerage accounts accept electronic payments. A check will be

mailed to the brokerage account address indicated above if the electronic payment is unable to successfully process. If no address is provided, a

check will be sent to the client’s address of record.

h Mail check to:

h Overnight

(No fee)

****

($25 fee)

****

h Address on record

h Alternate Address

Name ________________________________________________________________________________________________

Address _______________________________________________________________________________________________

City ______________________________________________________________State __________ Zip __________________

h Financial Institution

Account Number ________________________________________________________________________________________

Name _________________________________________________________________________________________________

Address _______________________________________________________________________________________________

City ______________________________________________________________State __________ Zip __________________

Telephone Number ______________________________________________________________________________________

Lincoln reserves the right to assess a fee; fees are subject to change.

****

Page 2 of 3

AN07119

8/12

1

1 2

2 3

3