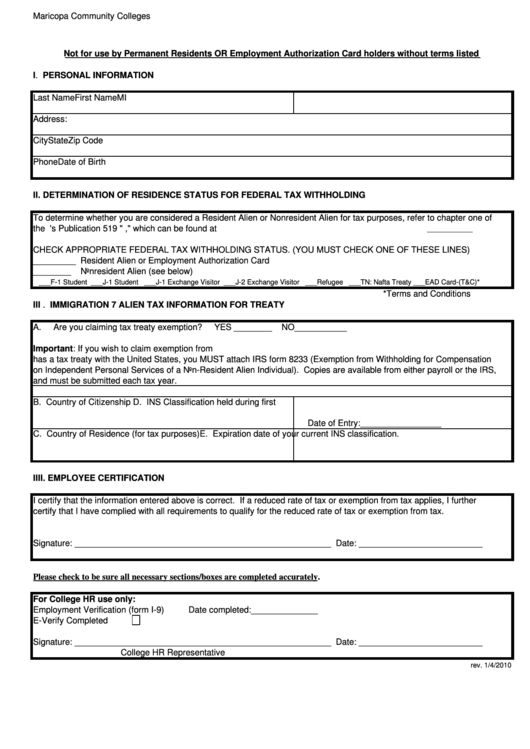

Maricopa Community Colleges

NON-U.S. CITIZEN EMPLOYEE TAX DATA FORM

Not for use by Permanent Residents OR Employment Authorization Card holders without terms listed

I. PERSONAL INFORMATION

Last Name

First Name

MI

U.S. Social Security Number

Address:

City

State

Zip Code

Phone

Date of Birth

II. DETERMINATION OF RESIDENCE STATUS FOR FEDERAL TAX WITHHOLDING

To determine whether you are considered a Resident Alien or Nonresident Alien for tax purposes, refer to chapter one of

the U.S. Internal Revenue Service's Publication 519 "U.S. Tax Guide for Aliens," which can be found at

CHECK APPROPRIATE FEDERAL TAX WITHHOLDING STATUS. (YOU MUST CHECK ONE OF THESE LINES)

_________ Resident Alien or Employment Authorization Card

________

Nonresident Alien (see below)

___F-1 Student ___J-1 Student ___J-1 Exchange Visitor ___J-2 Exchange Visitor ___Refugee ___TN: Nafta Treaty ___EAD Card-(T&C)*

*Terms and Conditions

III . IMMIGRATION 7 ALIEN TAX INFORMATION FOR TREATY

A.

Are you claiming tax treaty exemption?

YES ________

NO___________

Important: If you wish to claim exemption from U.S. Federal income taxes because your country of permanent residence

has a tax treaty with the United States, you MUST attach IRS form 8233 (Exemption from Withholding for Compensation

on Independent Personal Services of a Non-Resident Alien Individual). Copies are available from either payroll or the IRS,

and must be submitted each tax year.

B. Country of Citizenship

D. INS Classification held during first U.S. Entry

Date of Entry:_________________

C. Country of Residence (for tax purposes)

E. Expiration date of your current INS classification.

IIII. EMPLOYEE CERTIFICATION

I certify that the information entered above is correct. If a reduced rate of tax or exemption from tax applies, I further

certify that I have complied with all requirements to qualify for the reduced rate of tax or exemption from tax.

Signature: ______________________________________________________ Date: __________________________

Please check to be sure all necessary sections/boxes are completed accurately.

For College HR use only:

Employment Verification (form I-9)

Date completed:______________

E-Verify Completed

Signature: ______________________________________________________ Date: __________________________

College HR Representative

rev. 1/4/2010

1

1