Filing Procedures For Georgia Profit And Nonprofit Corporations Page 4

ADVERTISEMENT

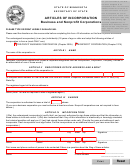

Publication of Notice of Intent to Incorporate.

All corporations must publish a notice of intent to incorporate in the newspaper which is the official legal organ of

the county where the initial registered office of the corporation is to be located, or in a newspaper of general

circulation in such county and for which at least 60 percent of its subscriptions are paid. A list of legal organs is

published at

,

or the Clerk of Superior Court can advise you as

to the legal organ in your county. The notice of intent to incorporate and a $40.00 publication fee should be

forwarded directly to the newspaper no later than the next business day after filing articles of incorporation with

the Secretary of State.

The notice should be in the following format:

NOTICE OF INCORPORATION

Dear Publisher:

Please publish once a week for two consecutive weeks a notice in the following form:

Notice is given that articles of incorporation that will incorporate (Name of Corporation) have been delivered to the Secretary

of State for filing in accordance with the Georgia Business Corporation Code (or Georgia Nonprofit Corporation Code). The

initial registered office of the corporation is located at (Address of Registered Office) and its initial registered agent at such

address is (Name of Registered Agent).

Enclosed is (check, draft or money order) in the amount of $40.00 in payment of the cost of publishing this notice.

Sincerely,

(Authorized signature)

Note to nonprofit corporations that will pursue “tax exempt” status:

Nonprofit corporations are not automatically tax exempt under 501(c)(3) or other sections of the Internal

Revenue Code by filing articles of incorporation with the Secretary of State. Nonprofit corporations must

make an Application for Recognition of Exemption to the IRS for exempt status.

Additional

information to that required by the Secretary of State will be required in the articles of

incorporation. Examples of such information are provided in IRS Publication 557. Said Publication,

necessary applications, and other exemption information can be accessed at , or

by calling the IRS. The IRS information should be included in the articles of incorporation if tax exempt

status will be sought by the nonprofit corporation. Otherwise, an amendment to articles, and a $20 filing

fee, will be required to add the material. IRS Publication 557 should be reviewed before incorporation if

a nonprofit corporation wishes to be “tax exempt.”

Professional legal and/or tax advice should be obtained regarding what material may or should be

included in the articles of a nonprofit corporation that wishes to be tax exempt. The Office of

Secretary of State cannot offer advice in this regard.

Other important information for corporations:

…An Employee Identification Number will be needed. It is obtained from the Internal Revenue Service by filing

Form SS-4. Call 1-800-829-3676 or visit the IRS web site.

…The Georgia Department of Revenue should be contacted regarding compliance with state tax laws. Income and

net worth tax information may be obtained by calling (404) 656-4191. Sales and withholding tax information may

be obtained by calling (404) 651-8651 or at the DOR’s web site,

…Many corporations will be required to obtain workers’ compensation insurance.

Workers’ compensation

information may be obtained by calling 1-800-533-0682 or (404) 656-3818.

…Many corporations will be subject to unemployment tax requirements of the “Georgia Employment Security

Law.” Information may be obtained from the Georgia Department of Labor at (404) 656-5590 or

…Nonprofit corporations that will be soliciting or accepting contributions in Georgia should contact the Charitable

Organizations section of the Office of Secretary of State at 802 West Tower, #2 Martin Luther King, Jr. Drive,

Atlanta, GA 30334 to determine if additional registration is required by law.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4