Form Ia 8453-Ind - Iowa Individual Income Tax Declaration For An E-File Return - 2015

ADVERTISEMENT

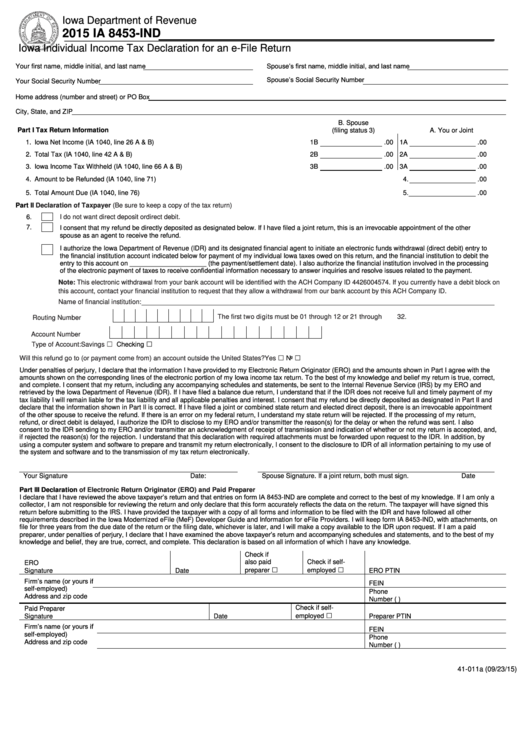

Iowa Department of Revenue

2015 IA 8453-IND

https://tax.iowa.gov

Iowa Individual Income Tax Declaration for an e-File Return

Spouse’s first name, middle initial, and last name

Your first name, middle initial, and last name

Spouse’s Social Security Number

Your Social Security Number

Home address (number and street) or PO Box

City, State, and ZIP

B. Spouse

Part I Tax Return Information

(filing status 3)

A. You or Joint

1. Iowa Net Income (IA 1040, line 26 A & B)

....................................................................................................

1B

.00

1A

.00

2. Total Tax (IA 1040, line 42 A & B)

...............................................................................................................

2B

.00

2A

.00

3. Iowa Income Tax Withheld (IA 1040, line 66 A & B)

.....................................................................................

3B

.00

3A

.00

4. Amount to be Refunded (IA 1040, line 71)

.............................................................................................................................

4.

.00

5. Total Amount Due (IA 1040, line 76)

.......................................................................................................................................

5.

.00

Part II

Declaration of Taxpayer (Be sure to keep a copy of the tax return)

6.

I do not want direct deposit or direct debit.

7.

I consent that my refund be directly deposited as designated below. If I have filed a joint return, this is an irrevocable appointment of the other

spouse as an agent to receive the refund.

I authorize the Iowa Department of Revenue (IDR) and its designated financial agent to initiate an electronic funds withdrawal (direct debit) entry to

the financial institution account indicated below for payment of my individual Iowa taxes owed on this return, and the financial institution to debit the

entry to this account on _____________________ (the payment/settlement date). I also authorize the financial institution involved in the processing

of the electronic payment of taxes to receive confidential information necessary to answer inquiries and resolve issues related to the payment.

Note: This electronic withdrawal from your bank account will be identified with the ACH Company ID 4426004574. If you currently have a debit block on

this account, contact your financial institution to request that they allow a withdrawal from our bank account by this ACH Company ID.

Name of financial institution:

The first two digits must be 01 through 12 or 21 through 32.

Routing Number

Account Number

Savings ☐

Checking ☐

Type of Account:

Will this refund go to (or payment come from) an account outside the United States? Yes ☐

No ☐

Under penalties of perjury, I declare that the information I have provided to my Electronic Return Originator (ERO) and the amounts shown in Part I agree with the

amounts shown on the corresponding lines of the electronic portion of my Iowa income tax return. To the best of my knowledge and belief my return is true, correct,

and complete. I consent that my return, including any accompanying schedules and statements, be sent to the Internal Revenue Service (IRS) by my ERO and

retrieved by the Iowa Department of Revenue (IDR). If I have filed a balance due return, I understand that if the IDR does not receive full and timely payment of my

tax liability I will remain liable for the tax liability and all applicable penalties and interest. I consent that my refund be directly deposited as designated in Part II and

declare that the information shown in Part II is correct. If I have filed a joint or combined state return and elected direct deposit, there is an irrevocable appointment

of the other spouse to receive the refund. If there is an error on my federal return, I understand my state return will be rejected. If the processing of my return,

refund, or direct debit is delayed, I authorize the IDR to disclose to my ERO and/or transmitter the reason(s) for the delay or when the refund was sent. I also

consent to the IDR sending to my ERO and/or transmitter an acknowledgment of receipt of transmission and indication of whether or not my return is accepted, and,

if rejected the reason(s) for the rejection. I understand that this declaration with required attachments must be forwarded upon request to the IDR. In addition, by

using a computer system and software to prepare and transmit my return electronically, I consent to the disclosure to IDR of all information pertaining to my use of

the system and software and to the transmission of my tax return electronically.

Your Signature

Date:

Spouse Signature. If a joint return, both must sign.

Date

Part III Declaration

of Electronic Return Originator (ERO) and Paid Preparer

I declare that I have reviewed the above taxpayer’s return and that entries on form IA 8453-IND are complete and correct to the best of my knowledge. If I am only a

collector, I am not responsible for reviewing the return and only declare that this form accurately reflects the data on the return. The taxpayer will have signed this

return before submitting to the IRS. I have provided the taxpayer with a copy of all forms and information to be filed with the IDR and have followed all other

requirements described in the Iowa Modernized eFile (MeF) Developer Guide and Information for eFile Providers. I will keep form IA 8453-IND, with attachments, on

file for three years from the due date of the return or the filing date, whichever is later, and I will make a copy available to the IDR upon request. If I am a paid

preparer, under penalties of perjury, I declare that I have examined the above taxpayer’s return and accompanying schedules and statements, and to the best of my

knowledge and belief, they are true, correct, and complete. This declaration is based on all information of which I have any knowledge.

Check if

also paid

Check if self-

ERO

preparer ☐

employed ☐

Signature

Date

ERO PTIN

Firm’s name (or yours if

FEIN

self-employed)

Phone

Address and zip code

Number (

)

Check if self-

Paid Preparer

employed ☐

Signature

Date

Preparer PTIN

Firm’s name (or yours if

FEIN

self-employed)

Phone

Address and zip code

Number (

)

41-011a (09/23/15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1