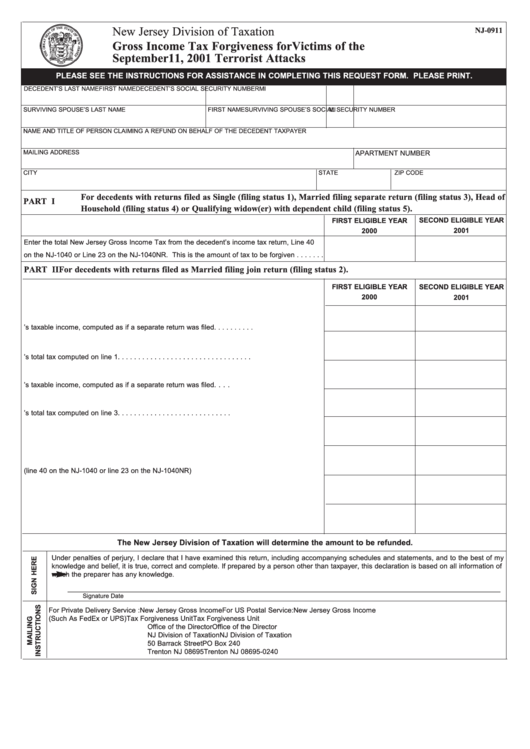

New Jersey Division of Taxation

NJ-0911

Gross Income Tax Forgiveness for Victims of the

September 11, 2001 Terrorist Attacks

PLEASE SEE THE INSTRUCTIONS FOR ASSISTANCE IN COMPLETING THIS REQUEST FORM. PLEASE PRINT.

DECEDENT’S LAST NAME

FIRST NAME

MI

DECEDENT’S SOCIAL SECURITY NUMBER

SURVIVING SPOUSE’S LAST NAME

FIRST NAME

MI

SURVIVING SPOUSE’S SOCIAL SECURITY NUMBER

NAME AND TITLE OF PERSON CLAIMING A REFUND ON BEHALF OF THE DECEDENT TAXPAYER

MAILING ADDRESS

APARTMENT NUMBER

CITY

STATE

ZIP CODE

For decedents with returns filed as Single (filing status 1), Married filing separate return (filing status 3), Head of

PART I

Household (filing status 4) or Qualifying widow(er) with dependent child (filing status 5).

FIRST ELIGIBLE YEAR

SECOND ELIGIBLE YEAR

2000

2001

Enter the total New Jersey Gross Income Tax from the decedent’s income tax return, Line 40

on the NJ-1040 or Line 23 on the NJ-1040NR. This is the amount of tax to be forgiven . . . . . . .

PART II

For decedents with returns filed as Married filing join return (filing status 2).

FIRST ELIGIBLE YEAR

SECOND ELIGIBLE YEAR

2000

2001

1. Enter the decedent’s taxable income, computed as if a separate return was filed. . . . . . . . . .

2. Enter the decedent’s total tax computed on line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . .

3. Enter the surviving spouse’s taxable income, computed as if a separate return was filed.

4. Enter the surviving spouse’s total tax computed on line 3. . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Add lines 2 and 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Enter the total tax from the joint return (line 40 on the NJ-1040 or line 23 on the NJ-1040NR)

7. Divide line 2 by line 5. Carry the result to four decimal places. . . . . . . . . . . . . . . . . . . . . . . .

8. Multiply line 6 by line 7. This is the amount of tax to be forgiven. . . . . . . . . . . . . . . . . . . . . .

The New Jersey Division of Taxation will determine the amount to be refunded.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct and complete. If prepared by a person other than taxpayer, this declaration is based on all information of

which the preparer has any knowledge.

_______________________________________________________________________________________________________________________________

Signature

Date

For Private Delivery Service :

New Jersey Gross Income

For US Postal Service:

New Jersey Gross Income

(Such As FedEx or UPS)

Tax Forgiveness Unit

Tax Forgiveness Unit

Office of the Director

Office of the Director

NJ Division of Taxation

NJ Division of Taxation

50 Barrack Street

PO Box 240

Trenton NJ 08695

Trenton NJ 08695-0240

1

1