Declaration For Estimated Taxes - Amherst Income Tax Department

ADVERTISEMENT

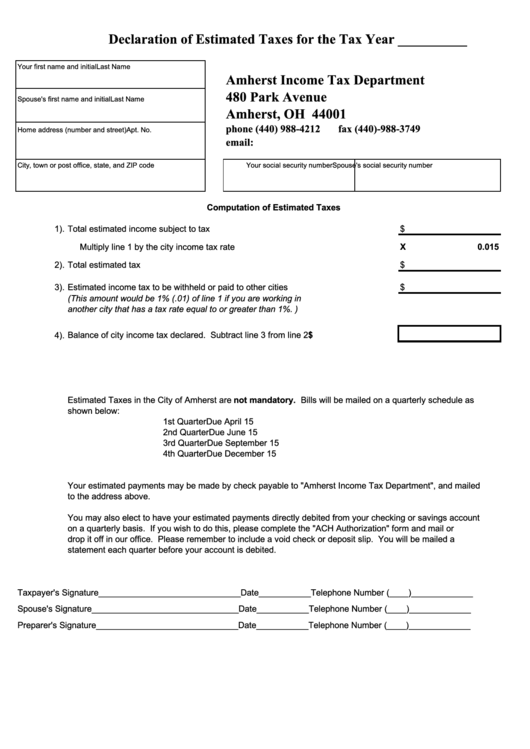

Declaration of Estimated Taxes for the Tax Year __________

Your first name and initial

Last Name

Amherst Income Tax Department

480 Park Avenue

Spouse's first name and initial

Last Name

Amherst, OH 44001

phone (440) 988-4212

fax (440)-988-3749

Home address (number and street)

Apt. No.

email:

City, town or post office, state, and ZIP code

Your social security number

Spouse's social security number

Computation of Estimated Taxes

1). Total estimated income subject to tax

$

Multiply line 1 by the city income tax rate

X

0.015

2). Total estimated tax

$

3). Estimated income tax to be withheld or paid to other cities

$

(This amount would be 1% (.01) of line 1 if you are working in

another city that has a tax rate equal to or greater than 1%. )

4). Balance of city income tax declared. Subtract line 3 from line 2

$

Estimated Taxes in the City of Amherst are not mandatory. Bills will be mailed on a quarterly schedule as

shown below:

1st Quarter

Due April 15

2nd Quarter

Due June 15

3rd Quarter

Due September 15

4th Quarter

Due December 15

Your estimated payments may be made by check payable to "Amherst Income Tax Department", and mailed

to the address above.

You may also elect to have your estimated payments directly debited from your checking or savings account

on a quarterly basis. If you wish to do this, please complete the "ACH Authorization" form and mail or

drop it off in our office. Please remember to include a void check or deposit slip. You will be mailed a

statement each quarter before your account is debited.

Taxpayer's Signature______________________________Date___________Telephone Number (____)_____________

Spouse's Signature_______________________________Date___________Telephone Number (____)_____________

Preparer's Signature______________________________Date___________Telephone Number (____)_____________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1