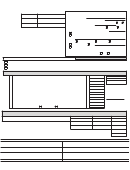

Form 22b/09npf - Net Profits License Fee Return - Lexington-Fayette Urban County Government - 2009 Page 2

ADVERTISEMENT

Account #

LEXINGTON−FAYETTE URBAN COUNTY GOVT

***IMPORTANT***

NET PROFIT WORKSHEET

Enclose Copy of Applicable

Federal Forms(s) & Schedule(s)

WORKSHEET I: For Business Entities required to file an INDIVIDUAL U.S. Income Tax Return

Non−employee compensation as reported on Form 1099−Misc Reported as "Other

1.

1.

Income" on federal Form 1040 (attach Page 1 of Form 1040 and Form 1099) ..................................

2.

2. Net profit or (loss) per Federal Schedule C of Form 1040

(Attach Schedule C, Pages 1 and 2)...................

Gain or loss on sales of business property from Federal Form 4797 or form 6252

3.

3.

reported on Schedule D of Form 1040 (Attach Form 4797 Pages 1 and 2 or Form 6262)...

4.

4. Rental income or (loss) per Federal Schedule E of Form 1040..............................................................................

5.

5. Net Farm income or (loss) per Federal Schedule F of Form 1040 ....................................................................

6.

6. State and local fees or taxes based on income deducted on Federal Schedule C, E or F...........

7.

7.

Total Income (Add lines 1 through 6)....................................................................................................................................................

8.

8. Alcoholic Beverage Sales Deduction (Attach Computation Sheet).......................................................................

9.

9. Other Adjustment (See instructions) (Attach schedule and full explanation)....................................................

10.

10. Adjusted Net Profit (Subtract line 8 and 9 from line 7)........................................................................................

Enter here and on line 1 of the Net Profit License Tax return

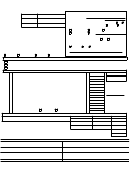

WORKSHEET P: For Business Entities required to file an PARTNERSHIP U.S. Income Tax Return

1.

Ordinary income or (loss) per Federal Form 1065 (Attach Form 1065, Pages 1, 2 and 3,

1.

Schedule of Other Deductions, and rental schedule(s), if applicable)......................................

2.

State and local license fees or taxes based on income deducted on the Federal Form 1065

2.

(Attach schedule)

3.

3. Additions from Schedule K of Federal Form 1065 (See instructions)...............................................................

(Attach Schedule K and rental schedules if applicable)

4.

4. Partner's Salaries..................................................................................................................................................................................................

5.

5. Total Income (Add lines 1 through 4)...............................................................................................................................................

6. Subtractions from Schedule K of Federal Form 1065 (See Instructions)......................................................... 6.

(Attach Schedule K and rental schedules if applicable)

7.

7.

Alcoholic Beverage Sales Deduction (Attach Computation Sheet)........................................................................

8.

8. Other Adjustments (See instructions) (Attach schedule and full explanation).................................................

9.

9. Total Adjustments (Add Lines 6 through 8) .................................................................................................................................

Adjusted Net Profit (Subtract line 9 from line 5)............................................................................................................

10.

10.

Enter here and on line 1 of the Net profit License Tax return

WORKSHEET C: For Business Entities required to file an CORPORATE U.S. Income Tax Return

Taxable income or (loss) per Federal Form 1120 or 1120A or Ordinary Income or (loss)

1.

per Federal Form 1120S (Attach the applicable 1120 or 1120A, Pages 1 and 2 or 1120S

1.

Pages 1, 2 and 3, Schedule of Other Deductions and rental schedules if applicable)......................

State and local license fees or taxes based on income deducted on the Federal Form

2.

2.

1120, 1120A or 1120S (Attach Schedule).................................................................................................................................

3.

3.

Net operating loss deduction.....................................................................................................................................................................

Additions from Schedule K of Federal Form 1120S (See instructions)...........................................................

4.

4.

(Attach Schedule K and rental schedules if applicable)

5.

Total Income (Add lines 1 through 4)...............................................................................................................................................

5.

Subtractions from Schedule K of Federal Form 1065 (See Instructions)......................................................

6.

6.

(Attach Schedule K and rental schedules if applicable)

7.

7.

Alcoholic Beverage Sales Deduction (Attach Computation Sheet).........................................................................

8. Other Adjustments (See instructions) (Attach schedule and full explanation)................................................... 8.

9.

Total Adjustments (Add Lines 6 through 8) .............................................................................................................................

9.

10.

Adjusted Net Profit (Subtract line 9 from line 5)...............................................................................................................

10.

Enter here and on line 1 of the Net profit License Tax return

Form 228/09NPB Revised 12/09

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2