Print and Reset Form

Reset Form

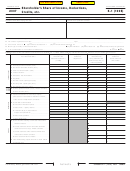

(a)

(b)

(c)

(d)

(e)

Pro-rata share items

Amount from

California

Total amounts

California

federal Schedule K-1

adjustment

using California law

source amounts

(1120S)

Combine (b) and (c)

and credits

where applicable

�5 a Depreciation adjustment on property placed in

service after 12/31/86 . . . . . . . . . . . . . . . . . . . . .

b Adjusted gain or loss . . . . . . . . . . . . . . . . . . . . .

c Depletion (other than oil and gas) . . . . . . . . . . . .

d � Gross income from oil, gas, and

geothermal properties . . . . . . . . . . . . . . . . . . .

2 Deductions allocable to oil, gas, and

geothermal properties . . . . . . . . . . . . . . . . . . .

e Other AMT items . Attach schedule . . . . . . . . . . .

�6 a Tax-exempt interest income . . . . . . . . . . . . . . . .

b Other tax-exempt income . . . . . . . . . . . . . . . . . .

c Nondeductible expenses . . . . . . . . . . . . . . . . . . .

d Total property distributions (including cash)

other than dividends distribution reported

on line 17c . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

e Repayment of loans from shareholders . . . . . . .

�7 a Investment income . See instructions . . . . . . . . .

b Investment expenses . See instructions . . . . . . . .

c Total taxable dividend distribution paid from

accumulated earnings and profits .

See instructions . . . . . . . . . . . . . . . . . . . . . . . . .

d Other information . See instructions . . . . . . . . . .

�8 a Type of income ________________________ . .

b Name of state _________________________ . .

c Total gross income from sources outside

California . Attach schedule . . . . . . . . . . . . . . . . .

d Total applicable deductions and losses .

Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . .

e Total other state taxes . Check one:

Paid

Accrued . . . . . . . . . . . . . . . . . . . .

Table � — Each shareholder’s share of nonbusiness income from intangibles . See instructions .

Interest

$ _________________ Royalties

$ __________________

Dividends

$ __________________

1231 Gains/Losses $ _________________ Capital Gains/Losses $ __________________

Other

$ __________________

FOR USE BY APPORTIONING UNITARY SHAREHOLDERS ONLY

Table 2 — Unitary shareholder’s pro-rata share of business income and factors — See instructions .

A . Shareholder’s share of the S corporation’s business income $________________________________

B . Shareholder’s share of the nonbusiness income from real and tangible property sourced or allocable to California:

Capital Gains/Losses

$ _____________________________

Rents/Royalties $ _______________________________

1231 Gains/Losses

$ _____________________________

Other

$ _______________________________

C . Shareholder’s share of the S corporation’s property, payroll, and sales:

Factors

Total within and outside California

Total within California

Property: Beginning

$

$

Ending

$

$

Annual Rent Expense

$

$

Payroll

$

$

Sales

$

$

Side 2 Schedule K-1 (100S) 2007

7872073

1

1 2

2