Print and Reset Form

Reset Form

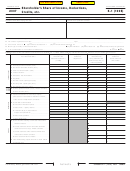

(a)

(b)

(c)

(d)

(e)

Distributive share items

Amounts from

California adjustments

Total amounts using

California

federal Schedule K-1

California law . Combine

source amounts

(1065)

col . (b) and col . (c)

and credits

�2 Expense deduction for recovery property

(IRC Section 179 and R&TC Sections 17267 .2,

17267 .6 and 17268) . . . . . . . . . . . . . . . . . . . . . . . .

�3 a Charitable contributions . . . . . . . . . . . . . . . . . . .

b Investment interest expense . . . . . . . . . . . . . . . .

c 1 Total expenditures to which an IRC

Section 59(e) election may apply

2 Type of expenditures ___________________ .

d Deductions related to portfolio income . . . . . . . .

e Other deductions . Attach schedule . . . . . . . . . . .

�5 a Total withholding (equals amount on

Form 592-B if calendar year partnership) . . . . . .

b Low-income housing credit . . . . . . . . . . . . . . . .

c Credits other than line 15b related to rental

real estate activities . . . . . . . . . . . . . . . . . . . . . . .

d Credits related to other rental activities . . . . . . . .

e Nonconsenting nonresident partner’s tax

paid by partnership . . . . . . . . . . . . . . . . . . . . . . .

f Other credits – Attach required schedules

or statements . . . . . . . . . . . . . . . . . . . . . . . . . . .

�7 a Depreciation adjustment on property place

in services after 1986 . . . . . . . . . . . . . . . . . . . . .

b Adjusted gain or loss . . . . . . . . . . . . . . . . . . . . .

c Depletion (other than oil & gas) . . . . . . . . . . . . .

d Gross income from oil, gas, and

geothermal properties . . . . . . . . . . . . . . . . . . . . .

e Deductions allocable to oil, gas, and

geothermal properties . . . . . . . . . . . . . . . . . . . . .

f Other alternative minimum tax items . . . . . . . . .

�8 a Tax-exempt interest income . . . . . . . . . . . . . . . .

b Other tax-exempt income . . . . . . . . . . . . . . . . . .

c Nondeductible expenses . . . . . . . . . . . . . . . . . . .

�9 a Distributions of money (cash and

marketable securities) . . . . . . . . . . . . . . . . . . . . .

b Distributions of property other than money . . . .

20 a Investment income . . . . . . . . . . . . . . . . . . . . . . .

b Investment expenses . . . . . . . . . . . . . . . . . . . . .

c Other information . See instructions . . . . . . . . . .

Side 2 Schedule K-1 (565) 2007

7892073

1

1 2

2 3

3