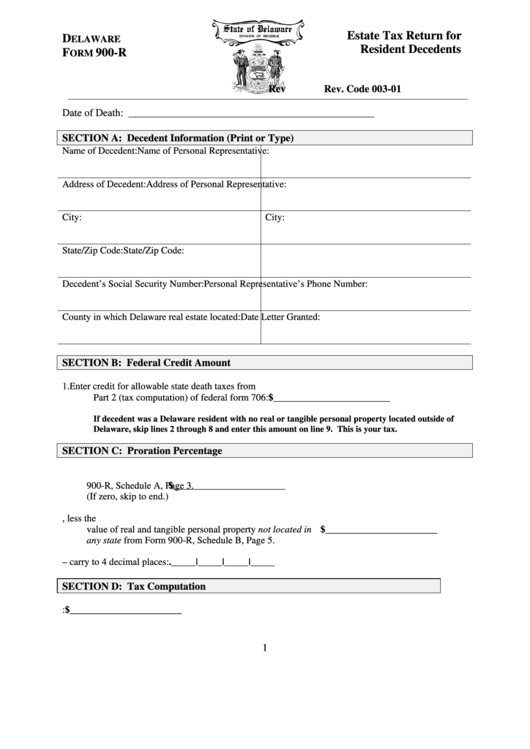

Delaware Form 900-R - Estate Tax Return For Resident Decedents

ADVERTISEMENT

Estate Tax Return for

D

ELAWARE

Resident Decedents

F

900-R

ORM

Rev

Rev. Code 003-01

Date of Death: _______________________________________________

SECTION A: Decedent Information (Print or Type)

Name of Decedent:

Name of Personal Representative:

Address of Decedent:

Address of Personal Representative:

City:

City:

State/Zip Code:

State/Zip Code:

Decedent’s Social Security Number:

Personal Representative’s Phone Number:

County in which Delaware real estate located:

Date Letter Granted:

SECTION B: Federal Credit Amount

1.

Enter credit for allowable state death taxes from

Part 2 (tax computation) of federal form 706:

$________________________

If decedent was a Delaware resident with no real or tangible personal property located outside of

Delaware, skip lines 2 through 8 and enter this amount on line 9. This is your tax.

SECTION C: Proration Percentage

2.

Enter the value of Delaware taxable property from Form

900-R, Schedule A, Page 3.

$_______________________

(If zero, skip to end.)

3.

Enter the value of the federal taxable estate tax, less the

value of real and tangible personal property not located in

$_______________________

any state from Form 900-R, Schedule B, Page 5.

4.

Divide line 2 by line 3 – carry to 4 decimal places:

._____|_____|_____|_____

SECTION D: Tax Computation

5.

Multiply line 1 by line 4:

$_______________________

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5