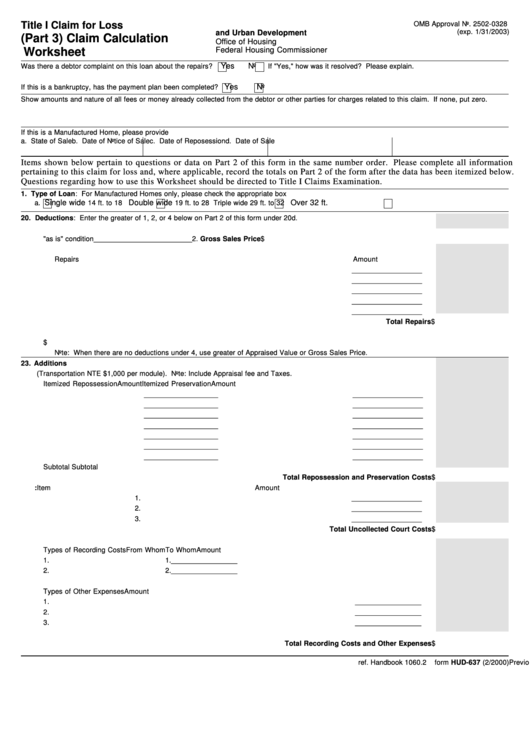

Title I Claim for Loss

U.S. Department of Housing

OMB Approval No. 2502-0328

(exp. 1/31/2003)

and Urban Development

(Part 3) Claim Calculation

Office of Housing

Federal Housing Commissioner

Worksheet

Yes

No

Was there a debtor complaint on this loan about the repairs?

If "Yes," how was it resolved? Please explain.

Yes

No

If this is a bankruptcy, has the payment plan been completed?

Show amounts and nature of all fees or money already collected from the debtor or other parties for charges related to this claim. If none, put zero.

If this is a Manufactured Home, please provide

a. State of Sale

b. Date of Notice of Sale

c. Date of Reposession

d. Date of Sale

Items shown below pertain to questions or data on Part 2 of this form in the same number order. Please complete all information

pertaining to this claim for loss and, where applicable, record the totals on Part 2 of the form after the data has been itemized below.

Questions regarding how to use this Worksheet should be directed to Title I Claims Examination.

1. Type of Loan: For Manufactured Homes only, please check the appropriate box

Single wide

Double wide

Over 32 ft.

a.

14 ft. to 18 ft.

b.

19 ft. to 28 ft.

c.

Triple wide 29 ft. to 32 ft.

d.

20. Deductions: Enter the greater of 1, 2, or 4 below on Part 2 of this form under 20d.

d. Best Price Obtainable

1. Appraised Value for "as is" condition _________________________

2. Gross Sales Price $

3. List Repairs and/or Other Items to make Marketable and deduct from Gross Sales Price

Repairs

Amount

__________________

__________________

__________________

__________________

__________________

Total Repairs $

4. Deduct Repair/Other Items from Gross Sales Price to determine ....

Net Sales Price $

Note: When there are no deductions under 4, use greater of Appraised Value or Gross Sales Price.

23. Additions

a. Repossession and Preservation Costs (Transportation NTE $1,000 per module). Note: Include Appraisal fee and Taxes.

Itemized Repossession

Amount

Itemized Preservation

Amount

___________________

__________________

___________________

__________________

___________________

__________________

___________________

__________________

___________________

__________________

___________________

__________________

___________________

__________________

Subtotal ................................

___________________

Subtotal ........................

__________________

Total Repossession and Preservation Costs $

c. Uncollected Court Costs: Item

Amount

1.

__________________

2.

__________________

3.

__________________

Total Uncollected Court Costs $

e. Recording Costs and Other Expenses

Types of Recording Costs

From Whom

To Whom

Amount

1.

1.

_________________

2.

2.

_________________

Types of Other Expenses

Amount

1.

_________________

2.

_________________

3.

_________________

Total Recording Costs and Other Expenses $

Previous edition is obsolete

ref. Handbook 1060.2

form HUD-637 (2/2000)

1

1