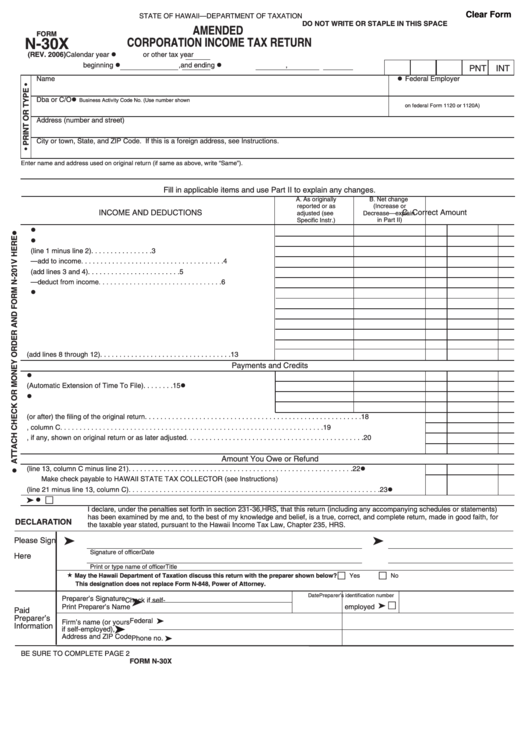

Clear Form

STATE OF HAWAII—DEPARTMENT OF TAXATION

DO NOT WRITE OR STAPLE IN THIS SPACE

AMENDED

FORM

N-30X

CORPORATION INCOME TAX RETURN

Calendar year l

(REV. 2006)

or other tax year

beginning l

and ending l

,

,

PNT

INT

l Federal Employer I.D. No.

Name

l

Dba or C/O

Business Activity Code No. (Use number shown

on federal Form 1120 or 1120A)

Address (number and street)

City or town, State, and ZIP Code. If this is a foreign address, see Instructions.

Enter name and address used on original return (if same as above, write “Same”).

Fill in applicable items and use Part II to explain any changes.

A. As originally

B. Net change

reported or as

(Increase or

INCOME AND DEDUCTIONS

C. Correct Amount

adjusted (see

Decrease—explain

Specific Instr.)

in Part II)

1. Total income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1l

2. Total deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2l

3. Taxable income before adjustments (line 1 minus line 2). . . . . . . . . . . . . . . .

3

4. Adjustments—add to income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5. Subtotal taxable income (add lines 3 and 4) . . . . . . . . . . . . . . . . . . . . . . . .

5

6. Adjustments—deduct from income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7. Taxable income for Hawaii tax purposes . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7l

8. Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9. Recapture of Capital Goods Excise Tax Credit . . . . . . . . . . . . . . . . . . . . . . .

9

10. Recapture of Low-Income Housing Tax Credit . . . . . . . . . . . . . . . . . . . . . . .

10

11. Recapture of High Technology Business Investment Tax Credit . . . . . . . . . .

11

12. Recapture of Tax Credit for Flood Victims . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13. Total tax (add lines 8 through 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

Payments and Credits

14. Estimated tax payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14l

15. Tax paid with Form N-301 (Automatic Extension of Time To File) . . . . . . . .

15l

16. Nonrefundable credits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16l

17. Other tax credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18. Tax paid with (or after) the filing of the original return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19. Total of lines 14 through 18, column C. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

20. Overpayment, if any, shown on original return or as later adjusted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

21. Line 19 minus line 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

Amount You Owe or Refund

22. Amount you owe (line 13, column C minus line 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22l

Make check payable to HAWAII STATE TAX COLLECTOR (see Instructions)

23. Refund (line 21 minus line 13, column C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23l

£

24. If the change pertains to a net operating loss carryback. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . check here ä l

I declare, under the penalties set forth in section 231-36, HRS, that this return (including any accompanying schedules or statements)

has been examined by me and, to the best of my knowledge and belief, is a true, correct, and complete return, made in good faith, for

DECLARATION

the taxable year stated, pursuant to the Hawaii Income Tax Law, Chapter 235, HRS.

ä

ä

Please Sign

Signature of officer

Date

Here

Print or type name of officer

Title

£

£

«

May the Hawaii Department of Taxation discuss this return with the preparer shown below?

Yes

No

This designation does not replace Form N-848, Power of Attorney.

Date

Preparer’s identification number

ä

Preparer’s Signature

Check if self-

£

employed ä

Print Preparer’s Name

Paid

Preparer’s

Federal E.I. No. ä

Firm’s name (or yours

Information

ä

if self-employed),

Address and ZIP Code

Phone no. ä

BE SURE TO COMPLETE PAGE 2

FORM N-30X

1

1 2

2