RESET

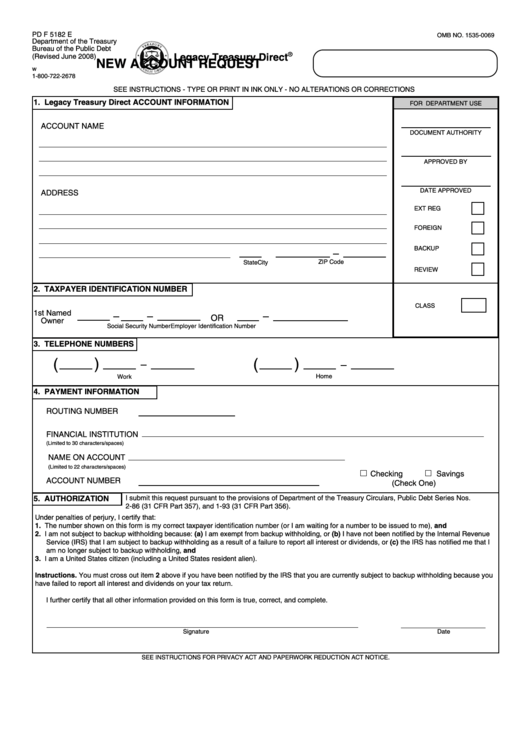

PD F 5182 E

OMB NO. 1535-0069

Department of the Treasury

Bureau of the Public Debt

®

(Revised June 2008)

Legacy Treasury Direct

NEW ACCOUNT REQUEST

1-800-722-2678

SEE INSTRUCTIONS - TYPE OR PRINT IN INK ONLY - NO ALTERATIONS OR CORRECTIONS

1. Legacy Treasury Direct ACCOUNT INFORMATION

FOR DEPARTMENT USE

ACCOUNT NAME

DOCUMENT AUTHORITY

APPROVED BY

DATE APPROVED

ADDRESS

EXT REG

FOREIGN

BACKUP

ZIP Code

City

State

REVIEW

2. TAXPAYER IDENTIFICATION NUMBER

CLASS

1st Named

OR

Owner

Social Security Number

Employer Identification Number

3. TELEPHONE NUMBERS

(

)

(

)

Work

Home

4. PAYMENT INFORMATION

ROUTING NUMBER

FINANCIAL INSTITUTION

(Limited to 30 characters/spaces)

NAME ON ACCOUNT

(Limited to 22 characters/spaces)

Checking

Savings

ACCOUNT NUMBER

(Check One)

I submit this request pursuant to the provisions of Department of the Treasury Circulars, Public Debt Series Nos.

5. AUTHORIZATION

2-86 (31 CFR Part 357), and 1-93 (31 CFR Part 356).

Under penalties of perjury, I certify that:

1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and

2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue

Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I

am no longer subject to backup withholding, and

3. I am a United States citizen (including a United States resident alien).

Instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you

have failed to report all interest and dividends on your tax return.

I further certify that all other information provided on this form is true, correct, and complete.

Signature

Date

SEE INSTRUCTIONS FOR PRIVACY ACT AND PAPERWORK REDUCTION ACT NOTICE.

1

1