Form Np-1 - Articles Of Agreement Of A New Hampshre Nonprifit Corporation

ADVERTISEMENT

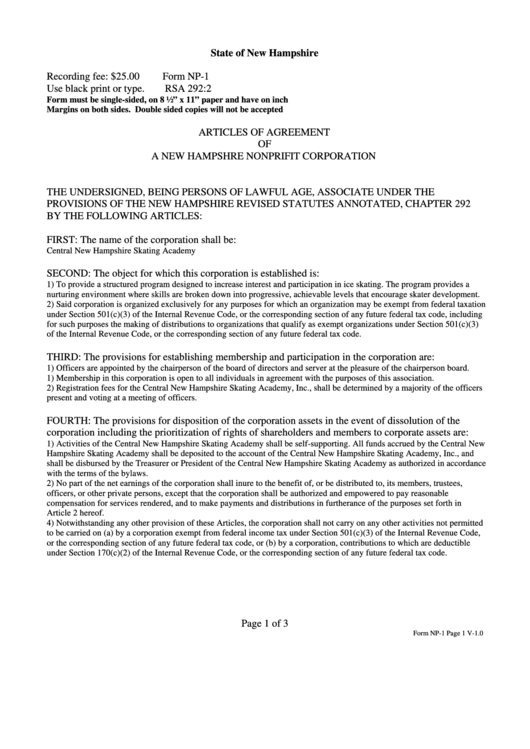

State of New Hampshire

Recording fee: $25.00

Form NP-1

Use black print or type.

RSA 292:2

Form must be single-sided, on 8 ½” x 11” paper and have on inch

Margins on both sides. Double sided copies will not be accepted

ARTICLES OF AGREEMENT

OF

A NEW HAMPSHRE NONPRIFIT CORPORATION

THE UNDERSIGNED, BEING PERSONS OF LAWFUL AGE, ASSOCIATE UNDER THE

PROVISIONS OF THE NEW HAMPSHIRE REVISED STATUTES ANNOTATED, CHAPTER 292

BY THE FOLLOWING ARTICLES:

FIRST: The name of the corporation shall be:

Central New Hampshire Skating Academy

SECOND: The object for which this corporation is established is:

1) To provide a structured program designed to increase interest and participation in ice skating. The program provides a

nurturing environment where skills are broken down into progressive, achievable levels that encourage skater development.

2) Said corporation is organized exclusively for any purposes for which an organization may be exempt from federal taxation

under Section 501(c)(3) of the Internal Revenue Code, or the corresponding section of any future federal tax code, including

for such purposes the making of distributions to organizations that qualify as exempt organizations under Section 501(c)(3)

of the Internal Revenue Code, or the corresponding section of any future federal tax code.

THIRD: The provisions for establishing membership and participation in the corporation are:

1) Officers are appointed by the chairperson of the board of directors and server at the pleasure of the chairperson board.

1) Membership in this corporation is open to all individuals in agreement with the purposes of this association.

2) Registration fees for the Central New Hampshire Skating Academy, Inc., shall be determined by a majority of the officers

present and voting at a meeting of officers.

FOURTH: The provisions for disposition of the corporation assets in the event of dissolution of the

corporation including the prioritization of rights of shareholders and members to corporate assets are:

1) Activities of the Central New Hampshire Skating Academy shall be self-supporting. All funds accrued by the Central New

Hampshire Skating Academy shall be deposited to the account of the Central New Hampshire Skating Academy, Inc., and

shall be disbursed by the Treasurer or President of the Central New Hampshire Skating Academy as authorized in accordance

with the terms of the bylaws.

2) No part of the net earnings of the corporation shall inure to the benefit of, or be distributed to, its members, trustees,

officers, or other private persons, except that the corporation shall be authorized and empowered to pay reasonable

compensation for services rendered, and to make payments and distributions in furtherance of the purposes set forth in

Article 2 hereof.

4) Notwithstanding any other provision of these Articles, the corporation shall not carry on any other activities not permitted

to be carried on (a) by a corporation exempt from federal income tax under Section 501(c)(3) of the Internal Revenue Code,

or the corresponding section of any future federal tax code, or (b) by a corporation, contributions to which are deductible

under Section 170(c)(2) of the Internal Revenue Code, or the corresponding section of any future federal tax code.

Page 1 of 3

Form NP-1 Page 1 V-1.0

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3