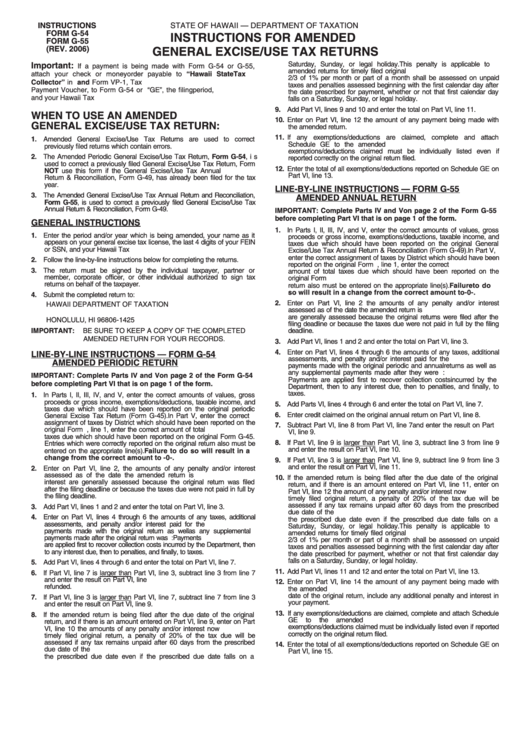

Form G-54 And Form G-55 - Instructions For Amended General Excise/use Tax Returns

ADVERTISEMENT

INSTRUCTIONS

STATE OF HAWAII — DEPARTMENT OF TAXATION

FORM G-54

INSTRUCTIONS FOR AMENDED

FORM G-55

(REV. 2006)

GENERAL EXCISE/USE TAX RETURNS

Saturday, Sunday, or legal holiday.

This penalty is applicable to

Important:

If a payment is being made with Form G-54 or G-55,

amended returns for timely filed original returns. Interest at the rate of

attach your check or money order payable to “Hawaii State Tax

2/3 of 1% per month or part of a month shall be assessed on unpaid

Collector” in U.S. dollars drawn on any U.S. bank and Form VP-1, Tax

taxes and penalties assessed beginning with the first calendar day after

Payment Voucher, to Form G-54 or G-55. Write “GE”, the filing period,

the date prescribed for payment, whether or not that first calendar day

and your Hawaii Tax I.D. No. on your check or money order.

falls on a Saturday, Sunday, or legal holiday.

9. Add Part VI, lines 9 and 10 and enter the total on Part VI, line 11.

WHEN TO USE AN AMENDED

10. Enter on Part VI, line 12 the amount of any payment being made with

GENERAL EXCISE/USE TAX RETURN:

the amended return.

11. If any exemptions/deductions are claimed, complete and attach

1. Amended General Excise/Use Tax Returns are used to correct

Schedule GE to the amended return.

The amount and type of

previously filed returns which contain errors.

exemptions/deductions claimed must be individually listed even if

2. The Amended Periodic General Excise/Use Tax Return, Form G-54, is

reported correctly on the original return filed.

used to correct a previously filed General Excise/Use Tax Return, Form

12. Enter the total of all exemptions/deductions reported on Schedule GE on

G-45. Do NOT use this form if the General Excise/Use Tax Annual

Part VI, line 13.

Return & Reconciliation, Form G-49, has already been filed for the tax

year.

LINE-BY-LINE INSTRUCTIONS — FORM G-55

3. The Amended General Excise/Use Tax Annual Return and Reconciliation,

AMENDED ANNUAL RETURN

Form G-55, is used to correct a previously filed General Excise/Use Tax

Annual Return & Reconciliation, Form G-49.

IMPORTANT: Complete Parts IV and V on page 2 of the Form G-55

before completing Part VI that is on page 1 of the form.

GENERAL INSTRUCTIONS

1. In Parts I, II, III, IV, and V, enter the correct amounts of values, gross

1. Enter the period and/or year which is being amended, your name as it

proceeds or gross income, exemptions/deductions, taxable income, and

appears on your general excise tax license, the last 4 digits of your FEIN

taxes due which should have been reported on the original General

or SSN, and your Hawaii Tax I.D. No. in the spaces provided.

Excise/Use Tax Annual Return & Reconciliation (Form G-49). In Part V,

enter the correct assignment of taxes by District which should have been

2. Follow the line-by-line instructions below for completing the returns.

reported on the original Form G-49. On Part VI, line 1, enter the correct

3. The return must be signed by the individual taxpayer, partner or

amount of total taxes due which should have been reported on the

member, corporate officer, or other individual authorized to sign tax

original Form G-49. Entries which were correctly reported on the original

returns on behalf of the taxpayer.

return also must be entered on the appropriate line(s). Failure to do

so will result in a change from the correct amount to -0-.

4. Submit the completed return to:

2. Enter on Part VI, line 2 the amounts of any penalty and/or interest

HAWAII DEPARTMENT OF TAXATION

assessed as of the date the amended return is filed. Penalty and interest

P.O. BOX 1425

are generally assessed because the original returns were filed after the

HONOLULU, HI 96806-1425

filing deadline or because the taxes due were not paid in full by the filing

IMPORTANT:

BE SURE TO KEEP A COPY OF THE COMPLETED

deadline.

AMENDED RETURN FOR YOUR RECORDS.

3. Add Part VI, lines 1 and 2 and enter the total on Part VI, line 3.

4. Enter on Part VI, lines 4 through 6 the amounts of any taxes, additional

LINE-BY-LINE INSTRUCTIONS — FORM G-54

assessments, and penalty and/or interest paid for the period. Include

AMENDED PERIODIC RETURN

payments made with the original periodic and annual returns as well as

any supplemental payments made after they were filed. REMINDER:

IMPORTANT: Complete Parts IV and V on page 2 of the Form G-54

Payments are applied first to recover collection costs incurred by the

before completing Part VI that is on page 1 of the form.

Department, then to any interest due, then to penalties, and finally, to

taxes.

1. In Parts I, II, III, IV, and V, enter the correct amounts of values, gross

proceeds or gross income, exemptions/deductions, taxable income, and

5. Add Parts VI, lines 4 through 6 and enter the total on Part VI, line 7.

taxes due which should have been reported on the original periodic

6. Enter credit claimed on the original annual return on Part VI, line 8.

General Excise Tax Return (Form G-45). In Part V, enter the correct

assignment of taxes by District which should have been reported on the

7. Subtract Part VI, line 8 from Part VI, line 7 and enter the result on Part

original Form G-45. On Part VI, line 1, enter the correct amount of total

VI, line 9.

taxes due which should have been reported on the original Form G-45.

8. If Part VI, line 9 is larger than Part VI, line 3, subtract line 3 from line 9

Entries which were correctly reported on the original return also must be

and enter the result on Part VI, line 10.

entered on the appropriate line(s). Failure to do so will result in a

change from the correct amount to -0-.

9. If Part VI, line 3 is larger than Part VI, line 9, subtract line 9 from line 3

and enter the result on Part VI, line 11.

2. Enter on Part VI, line 2, the amounts of any penalty and/or interest

assessed as of the date the amended return is filed.

Penalty and

10. If the amended return is being filed after the due date of the original

interest are generally assessed because the original return was filed

return, and if there is an amount entered on Part VI, line 11, enter on

after the filing deadline or because the taxes due were not paid in full by

Part VI, line 12 the amount of any penalty and/or interest now due. On a

the filing deadline.

timely filed original return, a penalty of 20% of the tax due will be

assessed if any tax remains unpaid after 60 days from the prescribed

3. Add Part VI, lines 1 and 2 and enter the total on Part VI, line 3.

due date of the return. The 60-day period is calculated beginning with

4. Enter on Part VI, lines 4 through 6 the amounts of any taxes, additional

the prescribed due date even if the prescribed due date falls on a

assessments, and penalty and/or interest paid for the period.

Include

Saturday, Sunday, or legal holiday.

This penalty is applicable to

payments made with the original return as well as any supplemental

amended returns for timely filed original returns. Interest at the rate of

payments made after the original return was filed. REMINDER: Payments

2/3 of 1% per month or part of a month shall be assessed on unpaid

are applied first to recover collection costs incurred by the Department, then

taxes and penalties assessed beginning with the first calendar day after

to any interest due, then to penalties, and finally, to taxes.

the date prescribed for payment, whether or not that first calendar day

falls on a Saturday, Sunday, or legal holiday.

5. Add Part VI, lines 4 through 6 and enter the total on Part VI, line 7.

11. Add Part VI, lines 11 and 12 and enter the total on Part VI, line 13.

6. If Part VI, line 7 is larger than Part VI, line 3, subtract line 3 from line 7

and enter the result on Part VI, line 8. This is the amount of credit to be

12. Enter on Part VI, line 14 the amount of any payment being made with

refunded.

the amended return. If the amended return is being filed after the due

date of the original return, include any additional penalty and interest in

7. If Part VI, line 3 is larger than Part VI, line 7, subtract line 7 from line 3

your payment.

and enter the result on Part VI, line 9.

13. If any exemptions/deductions are claimed, complete and attach Schedule

8. If the amended return is being filed after the due date of the original

GE

to

the

amended

return.

The

amount

and

type

of

return, and if there is an amount entered on Part VI, line 9, enter on Part

exemptions/deductions claimed must be individually listed even if reported

VI, line 10 the amounts of any penalty and/or interest now due. On a

correctly on the original return filed.

timely filed original return, a penalty of 20% of the tax due will be

assessed if any tax remains unpaid after 60 days from the prescribed

14. Enter the total of all exemptions/deductions reported on Schedule GE on

due date of the return. The 60-day period is calculated beginning with

Part VI, line 15.

the prescribed due date even if the prescribed due date falls on a

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1