Instructions For Quarterly Schedule N-Att(Form St-810.5-Att) For Part-Quarterly Filers - Taxes On Parking Services In New York City

ADVERTISEMENT

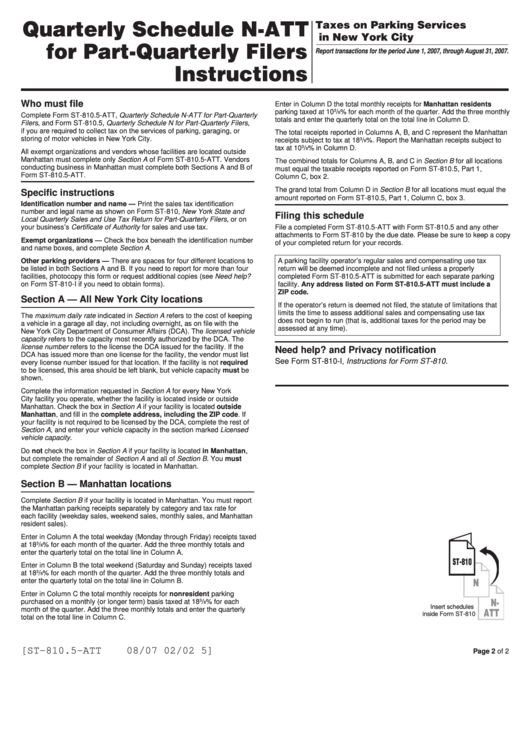

Quarterly Schedule N-ATT

Taxes on Parking Services

in New York City

for Part-Quarterly Filers

Report transactions for the period June 1, 2007, through August 31, 2007.

Instructions

Who must file

Enter in Column D the total monthly receipts for Manhattan residents

parking taxed at 10

3

/

% for each month of the quarter. Add the three monthly

8

Complete Form ST‑810.5‑ATT, Quarterly Schedule N-ATT for Part-Quarterly

totals and enter the quarterly total on the total line in Column D.

Filers, and Form ST‑810.5, Quarterly Schedule N for Part-Quarterly Filers,

if you are required to collect tax on the services of parking, garaging, or

The total receipts reported in Columns A, B, and C represent the Manhattan

storing of motor vehicles in New York City.

receipts subject to tax at 18

3

/

%. Report the Manhattan receipts subject to

8

tax at 10

3

/

% in Column D.

8

All exempt organizations and vendors whose facilities are located outside

Manhattan must complete only Section A of Form ST‑810.5‑ATT. Vendors

The combined totals for Columns A, B, and C in Section B for all locations

conducting business in Manhattan must complete both Sections A and B of

must equal the taxable receipts reported on Form ST‑810.5, Part 1,

Form ST‑810.5‑ATT.

Column C, box 2.

The grand total from Column D in Section B for all locations must equal the

Specific instructions

amount reported on Form ST‑810.5, Part 1, Column C, box 3.

Identification number and name — Print the sales tax identification

number and legal name as shown on Form ST‑810, New York State and

Filing this schedule

Local Quarterly Sales and Use Tax Return for Part-Quarterly Filers, or on

your business’s Certificate of Authority for sales and use tax.

File a completed Form ST‑810.5‑ATT with Form ST‑810.5 and any other

attachments to Form ST‑810 by the due date. Please be sure to keep a copy

Exempt organizations — Check the box beneath the identification number

of your completed return for your records.

and name boxes, and complete Section A.

Other parking providers — There are spaces for four different locations to

A parking facility operator’s regular sales and compensating use tax

be listed in both Sections A and B. If you need to report for more than four

return will be deemed incomplete and not filed unless a properly

facilities, photocopy this form or request additional copies (see Need help?

completed Form ST‑810.5‑ATT is submitted for each separate parking

facility. Any address listed on Form ST-810.5-ATT must include a

on Form ST‑810‑I if you need to obtain forms).

ZIP code.

Section A — All New York City locations

If the operator’s return is deemed not filed, the statute of limitations that

limits the time to assess additional sales and compensating use tax

The maximum daily rate indicated in Section A refers to the cost of keeping

does not begin to run (that is, additional taxes for the period may be

a vehicle in a garage all day, not including overnight, as on file with the

assessed at any time).

New York City Department of Consumer Affairs (DCA). The licensed vehicle

capacity refers to the capacity most recently authorized by the DCA. The

license number refers to the license the DCA issued for the facility. If the

Need help? and Privacy notification

DCA has issued more than one license for the facility, the vendor must list

See Form ST‑810‑I, Instructions for Form ST-810.

every license number issued for that location. If the facility is not required

to be licensed, this area should be left blank, but vehicle capacity must be

shown.

Complete the information requested in Section A for every New York

City facility you operate, whether the facility is located inside or outside

Manhattan. Check the box in Section A if your facility is located outside

Manhattan, and fill in the complete address, including the ZIP code. If

your facility is not required to be licensed by the DCA, complete the rest of

Section A, and enter your vehicle capacity in the section marked Licensed

vehicle capacity.

Do not check the box in Section A if your facility is located in Manhattan,

but complete the remainder of Section A and all of Section B. You must

complete Section B if your facility is located in Manhattan.

Section B — Manhattan locations

Complete Section B if your facility is located in Manhattan. You must report

the Manhattan parking receipts separately by category and tax rate for

each facility (weekday sales, weekend sales, monthly sales, and Manhattan

resident sales).

Enter in Column A the total weekday (Monday through Friday) receipts taxed

3

at 18

/

% for each month of the quarter. Add the three monthly totals and

8

enter the quarterly total on the total line in Column A.

ST-810

Enter in Column B the total weekend (Saturday and Sunday) receipts taxed

at 18

3

/

% for each month of the quarter. Add the three monthly totals and

8

N

enter the quarterly total on the total line in Column B.

Enter in Column C the total monthly receipts for nonresident parking

N-

3

purchased on a monthly (or longer term) basis taxed at 18

/

% for each

8

Insert schedules

ATT

month of the quarter. Add the three monthly totals and enter the quarterly

inside Form ST‑810

total on the total line in Column C.

[ST-810.5-ATT

08/07 02/02 5]

Page 2 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1