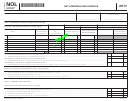

Schedule Nol Draft - Attach To Form 720 - Net Operating Loss Schedule - 2017 Page 3

ADVERTISEMENT

SCHEDULE NOL

INSTRUCTIONS FOR SCHEDULE NOL

Page 3 of 3

(2017)

Line 7—If the amount of loss limitation on Line 4 is greater than the net

Section B – NOL Carryforward (Mandatory Nexus Consolidated)

operating loss(es) on Column C, Line 3, a prior year NOL carryforward can

be used to meet the 50 percent loss limitation. Enter the lesser of Line 4 less

General Instructions – Part I, Section B is used by an affiliated group filing a

Column C, Line 3, or the amount entered on Column A, Line 3. If the amount

mandatory nexus consolidated return per KRS 141.200(11) to track any available

of Line 4 less Column C, Line 3, is greater than Column A, Line 3, enter the

net operating loss carryforward. Follow the instructions on Lines 1 through 3.

amount from Column A, Line 3. Enter the amount on Form 720, Part III, Line 19.

This is a deduction in computing Kentucky net income. Use worksheet below.

Part II – Separate Entity Return

NOL Carryforward

General Instructions – Part II is used by a corporation filing a separate entity

Worksheet—Line 7

return per KRS 141.200(10) to track any available net operating loss carryforward.

1.

Amount from Line 4 .....................................$ __________________

Follow the instructions on Lines 1 through 4.

2. Amount from Column C, Line 3 ..................$ __________________

3. Line 1 less Line 2. (If less than zero,

skip and complete Line 6 above) ................$ __________________

4. Amount from Column A, Line 3 ..................$ __________________

5. Lesser of Line 3 or Line 4. Enter

here and on Part I, Section A,

Line 7 .............................................................$ __________________

DRAFT

6 / 1 / 1 7

41A720NOL (16JUN17-DRAFT)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3