Form Ct-1120cc-R - Revocation Of Election And Consent To File Combined Corporation Business Tax Return

ADVERTISEMENT

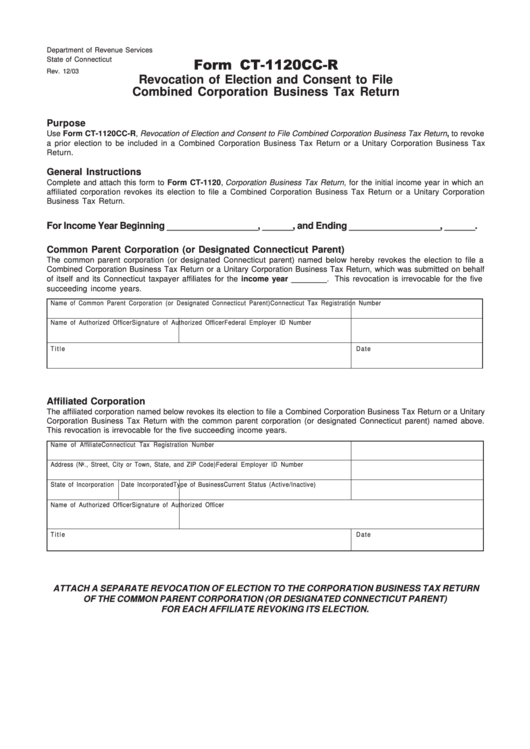

Department of Revenue Services

Form CT-1120CC-R

State of Connecticut

Rev. 12/03

Revocation of Election and Consent to File

Combined Corporation Business Tax Return

Purpose

Use Form CT-1120CC-R, Revocation of Election and Consent to File Combined Corporation Business Tax Return, to revoke

a prior election to be included in a Combined Corporation Business Tax Return or a Unitary Corporation Business Tax

Return.

General Instructions

Complete and attach this form to Form CT-1120, Corporation Business Tax Return, for the initial income year in which an

affiliated corporation revokes its election to file a Combined Corporation Business Tax Return or a Unitary Corporation

Business Tax Return.

For Income Year Beginning __________________, ______, and Ending __________________, ______.

Common Parent Corporation (or Designated Connecticut Parent)

The common parent corporation (or designated Connecticut parent) named below hereby revokes the election to file a

Combined Corporation Business Tax Return or a Unitary Corporation Business Tax Return, which was submitted on behalf

of itself and its Connecticut taxpayer affiliates for the income year ________. This revocation is irrevocable for the five

succeeding income years.

Name of Common Parent Corporation (or Designated Connecticut Parent)

Connecticut Tax Registration Number

Name of Authorized Officer

Signature of Authorized Officer

Federal Employer ID Number

T i t l e

D a t e

Affiliated Corporation

The affiliated corporation named below revokes its election to file a Combined Corporation Business Tax Return or a Unitary

Corporation Business Tax Return with the common parent corporation (or designated Connecticut parent) named above.

This revocation is irrevocable for the five succeeding income years.

Name of Affiliate

Connecticut Tax Registration Number

Address (No., Street, City or Town, State, and ZIP Code)

Federal Employer ID Number

State of Incorporation

Date Incorporated

Type of Business

Current Status (Active/Inactive)

Name of Authorized Officer

Signature of Authorized Officer

T i t l e

D a t e

ATTACH A SEPARATE REVOCATION OF ELECTION TO THE CORPORATION BUSINESS TAX RETURN

OF THE COMMON PARENT CORPORATION (OR DESIGNATED CONNECTICUT PARENT)

FOR EACH AFFILIATE REVOKING ITS ELECTION.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1