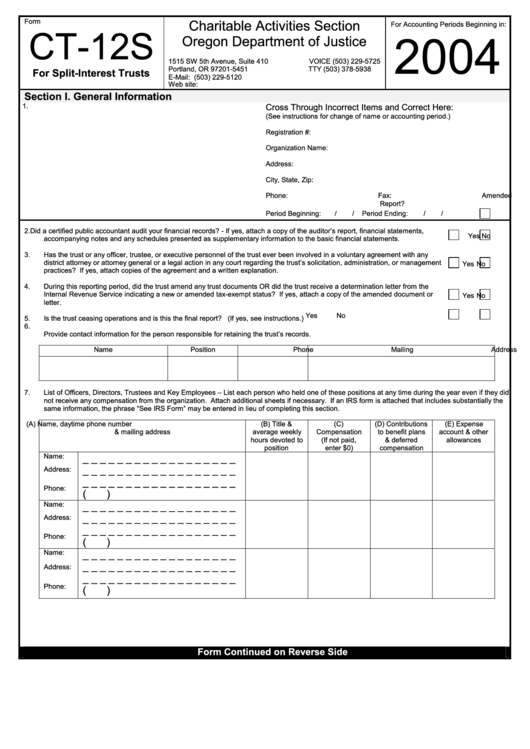

Form

Charitable Activities Section

For Accounting Periods Beginning in:

CT-12S

2004

Oregon Department of Justice

1515 SW 5th Avenue, Suite 410

VOICE (503) 229-5725

Portland, OR 97201-5451

TTY

(503) 378-5938

For Split-Interest Trusts

E-Mail: charitable.activities@doj.state.or.us

FAX

(503) 229-5120

Web site:

Section I.

General Information

1.

Cross Through Incorrect Items and Correct Here:

(See instructions for change of name or accounting period.)

Registration #:

Organization Name:

Address:

City, State, Zip:

Phone:

Fax:

Amended

Report?

Period Beginning:

/

/

Period Ending:

/

/

2.

Did a certified public accountant audit your financial records? - If yes, attach a copy of the auditor’s report, financial statements,

Yes

No

accompanying notes and any schedules presented as supplementary information to the basic financial statements.

3.

Has the trust or any officer, trustee, or executive personnel of the trust ever been involved in a voluntary agreement with any

district attorney or attorney general or a legal action in any court regarding the trust’s solicitation, administration, or management

Yes

No

practices? If yes, attach copies of the agreement and a written explanation.

4.

During this reporting period, did the trust amend any trust documents OR did the trust receive a determination letter from the

Internal Revenue Service indicating a new or amended tax-exempt status? If yes, attach a copy of the amended document or

Yes

No

letter.

Yes

No

5.

Is the trust ceasing operations and is this the final report?

(If yes, see instructions.)

6.

Provide contact information for the person responsible for retaining the trust’s records.

Name

Position

Phone

Mailing Address

7.

List of Officers, Directors, Trustees and Key Employees – List each person who held one of these positions at any time during the year even if they did

not receive any compensation from the organization. Attach additional sheets if necessary. If an IRS form is attached that includes substantially the

same information, the phrase “See IRS Form” may be entered in lieu of completing this section.

(A) Name, daytime phone number

(B) Title &

(C)

(D) Contributions

(E) Expense

& mailing address

average weekly

Compensation

to benefit plans

account & other

hours devoted to

(If not paid,

& deferred

allowances

position

enter $0)

compensation

Name:

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Address:

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Phone:

(

)

Name:

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Address:

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Phone:

(

)

Name:

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Address:

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Phone:

(

)

Form Continued on Reverse Side

1

1 2

2