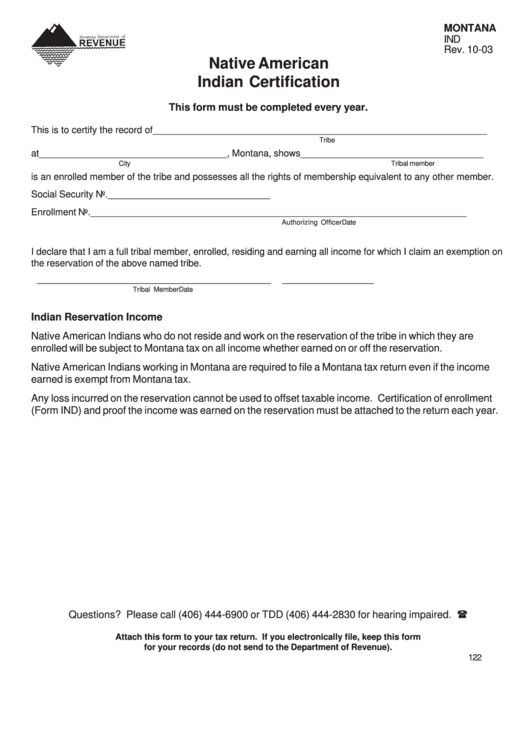

MONTANA

IND

Rev. 10-03

Native American

Indian Certification

This form must be completed every year.

This is to certify the record of ________________________________________________________________

Tribe

at ____________________________________ , Montana, shows ___________________________________

City

Tribal member

is an enrolled member of the tribe and possesses all the rights of membership equivalent to any other member.

Social Security No. _______________________________

Enrollment No. ______________________

_________________________________

_________________

Authorizing Officer

Date

I declare that I am a full tribal member, enrolled, residing and earning all income for which I claim an exemption on

the reservation of the above named tribe.

_________________________________________

________________

Tribal Member

Date

Indian Reservation Income

Native American Indians who do not reside and work on the reservation of the tribe in which they are

enrolled will be subject to Montana tax on all income whether earned on or off the reservation.

Native American Indians working in Montana are required to file a Montana tax return even if the income

earned is exempt from Montana tax.

Any loss incurred on the reservation cannot be used to offset taxable income. Certification of enrollment

(Form IND) and proof the income was earned on the reservation must be attached to the return each year.

Questions? Please call (406) 444-6900 or TDD (406) 444-2830 for hearing impaired.

Attach this form to your tax return. If you electronically file, keep this form

for your records (do not send to the Department of Revenue).

122

1

1