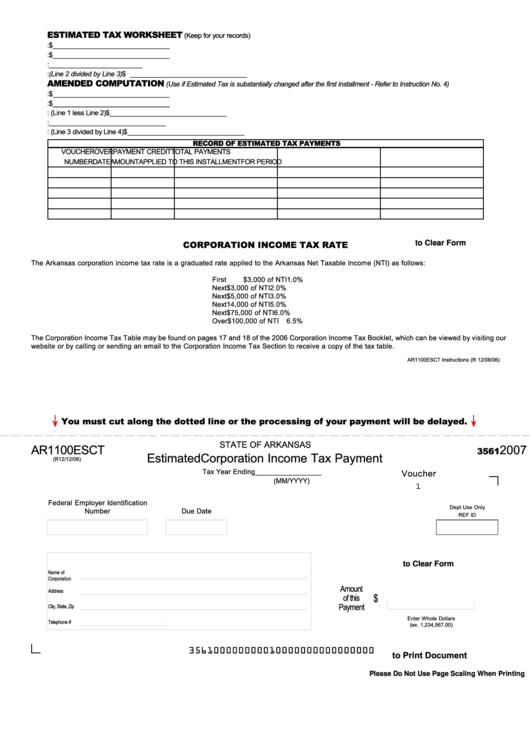

ESTIMATED TAX WORKSHEET

(Keep for your records)

1. Taxable Income Expected: ..................................................................................................................... $ ______________________________

2. Estimated Income Tax Liability: .............................................................................................................. $ ______________________________

3. Number of Installments: .........................................................................................................................

______________________________

4. Amount of Each Installment: (Line 2 divided by Line 3) ........................................................................... $ ______________________________

AMENDED COMPUTATION

(Use if Estimated Tax is substantially changed after the first installment - Refer to Instruction No. 4)

1. Amended Estimated Tax: ....................................................................................................................... $ ______________________________

2. Less Amount of Prior Estimated Tax Payment Made: .............................................................................. $ ______________________________

3. Balance: (Line 1 less Line 2) .................................................................................................................. $ ______________________________

4. Number of Remaining Installments: .......................................................................................................

______________________________

5. Amount of Each Installment: (Line 3 divided by Line 4) ........................................................................... $ ______________________________

RECORD OF ESTIMATED TAX PAYMENTS

VOUCHER

OVERPAYMENT CREDIT

TOTAL PAYMENTS

NUMBER

DATE

AMOUNT

APPLIED TO THIS INSTALLMENT

FOR PERIOD

CORPORATION INCOME TAX RATE

Click Here to Clear Form

The Arkansas corporation income tax rate is a graduated rate applied to the Arkansas Net Taxable Income (NTI) as follows:

First

$3,000 of NTI

1.0%

Next

$3,000 of NTI

2.0%

Next

$5,000 of NTI

3.0%

Next

14,000 of NTI

5.0%

Next

$75,000 of NTI

6.0%

Over

$100,000 of NTI

6.5%

The Corporation Income Tax Table may be found on pages 17 and 18 of the 2006 Corporation Income Tax Booklet, which can be viewed by visiting our

website or by calling or sending an email to the Corporation Income Tax Section to receive a copy of the tax table.

AR1100ESCT Instructions (R 12/08/06)

You must cut along the dotted line or the processing of your payment will be delayed.

STATE OF ARKANSAS

AR1100ESCT

2007

3561

Estimated Corporation Income Tax Payment

(R12/12/06)

Tax Year Ending _________________

Voucher

(MM/YYYY)

1

Federal Employer Identification

Dept Use Only

Number

Due Date

REF ID

Click Here to Clear Form

Name of

Corporation

Amount

Address

$

of this

Payment

City, State, Zip

Enter Whole Dollars

Telephone #

(ex. 1,234,567.00)

356100000000010000000000000000

Click Here to Print Document

Please Do Not Use Page Scaling When Printing

1

1 2

2 3

3 4

4