Schedule Tc (Form Gr-1040) - Part-Year Resident Tax Calculation - City Of Grand Rapids - 2010

ADVERTISEMENT

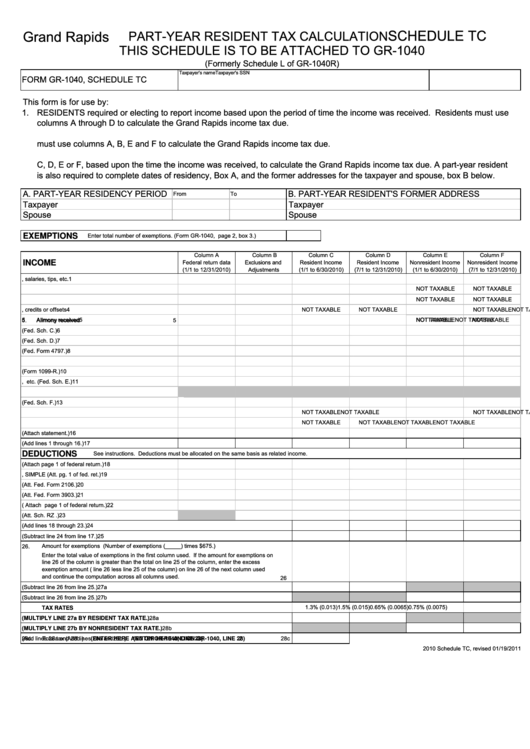

SCHEDULE TC

Grand Rapids

PART-YEAR RESIDENT TAX CALCULATION

THIS SCHEDULE IS TO BE ATTACHED TO GR-1040

(Formerly Schedule L of GR-1040R)

Taxpayer's name

Taxpayer's SSN

FORM GR-1040, SCHEDULE TC

This form is for use by:

1.

RESIDENTS required or electing to report income based upon the period of time the income was received. Residents must use

columns A through D to calculate the Grand Rapids income tax due.

2. NONRESIDENTS required or electing to report income based upon the period of time the income was received. Nonresidents

must use columns A, B, E and F to calculate the Grand Rapids income tax due.

3. PART-YEAR RESIDENTS. A part-year resident must use columns A and B and the the proper resident or nonresident columns

C, D, E or F, based upon the time the income was received, to calculate the Grand Rapids income tax due. A part-year resident

is also required to complete dates of residency, Box A, and the former addresses for the taxpayer and spouse, box B below.

A. PART-YEAR RESIDENCY PERIOD

B. PART-YEAR RESIDENT'S FORMER ADDRESS

From

To

Taxpayer

Taxpayer

Spouse

Spouse

Enter total number of exemptions. (Form GR-1040, page 2, box 3.)

EXEMPTIONS

Column A

Column B

Column C

Column D

Column E

Column F

Federal return data

Exclusions and

Resident Income

Resident Income

Nonresident Income

Nonresident Income

INCOME

(1/1 to 12/31/2010)

Adjustments

(1/1 to 6/30/2010)

(7/1 to 12/31/2010)

(1/1 to 6/30/2010)

(7/1 to 12/31/2010)

1.

Wages, salaries, tips, etc.

1

NOT TAXABLE

NOT TAXABLE

2.

Taxable interest

2

NOT TAXABLE

NOT TAXABLE

3.

Ordinary dividends

3

NOT TAXABLE

NOT TAXABLE

NOT TAXABLE

NOT TAXABLE

4.

Taxable refunds, credits or offsets

4

5

Alimony received

5

NOT TAXABLE

NOT TAXABLE

NOT TAXABLE

NOT TAXABLE

5.

Alimony received

5

6.

Business income (Fed. Sch. C.)

6

7.

Capital gains or losses (Fed. Sch. D.)

7

8.

Other gains or losses (Fed. Form 4797.)

8

9.

Taxable IRA distributions

9

10.

Taxable pension distributions (Form 1099-R.)

10

11.

Rental real estate, etc. (Fed. Sch. E.)

11

12.

Reserved

12

13.

Farm income or loss (Fed. Sch. F.)

13

NOT TAXABLE

NOT TAXABLE

NOT TAXABLE

NOT TAXABLE

14.

Unemployment compensation

14

NOT TAXABLE

NOT TAXABLE

NOT TAXABLE

NOT TAXABLE

15.

Social security benefits

15

16.

Other income (Attach statement.)

16

17.

Total income (Add lines 1 through 16.)

17

See instructions. Deductions must be allocated on the same basis as related income.

DEDUCTIONS

18.

IRA deduction (Attach page 1 of federal return.)

18

19.

Self Employed SEP, SIMPLE (Att. pg. 1 of fed. ret.) 19

20.

Employee business expenses (Att. Fed. Form 2106.) 20

21.

Moving expenses (Att. Fed. Form 3903.)

21

22.

Alimony paid ( Attach page 1 of federal return.)

22

23.

Renaissance Zone deduction (Att. Sch. RZ .)

23

24.

Total deductions (Add lines 18 through 23.)

24

25.

Total income after deductions (Subtract line 24 from line 17.)

25

Amount for exemptions (Number of exemptions (_____) times $675.)

26.

Enter the total value of exemptions in the first column used. If the amount for exemptions on

line 26 of the column is greater than the total on line 25 of the column, enter the excess

exemption amount ( line 26 less line 25 of the column) on line 26 of the next column used

and continue the computation across all columns used.

26

27a.

Total income subject to tax as a resident (Subtract line 26 from line 25.)

27a

27b.

Total income subject to tax as a nonresident (Subtract line 26 from line 25.)

27b

1.3% (0.013)

1.5% (0.015)

0.65% (0.0065)

0.75% (0.0075)

TAX RATES

28a.

Tax at resident rate

28a

(MULTIPLY LINE 27a BY RESIDENT TAX RATE.)

28b.

Tax at nonresident rate

28b

(MULTIPLY LINE 27b BY NONRESIDENT TAX RATE.)

28c.

28c.

Total tax (Add lines 28a and 28b.)

Total tax (Add lines 28a and 28b.)

2

28c

(ENTER HERE AND ON GR-1040, LINE 28)

(ENTER HERE AND ON GR-1040, LINE 28)

2010 Schedule TC, revised 01/19/2011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1