2015 Form 3

Name

ID Number

Page 7 of 7

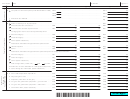

Part III Schedule 3K – Partners’ Share of Subtractions

Subtractions:

.

9 Related entity expenses eligible for subtraction (from Schedule RT, Part II) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

.

10 Income from related entities whose expenses were disallowed (obtain Schedule RT-1 from related entity and submit with your return) . . 10

00

.

00

11 Basis, section 179, depreciation/amortization of assets (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

.

00

12 Amount by which the Wisconsin basis of assets disposed of exceeds the federal basis (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . 12

.

13 Federal work opportunity credit wages. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

00

.

00

14 Federal research credit expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Other subtractions:

.

a

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15a

00

.

00

b

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15b

.

00

c

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15c

.

00

d

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15d

.

e Total other subtractions (add lines 15a through 15d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15e

00

.

16 Total subtractions (add lines 9 through 15e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

00

.

17 Total adjustment. (Subtract line 16 from line 8. See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

00

Return to Page 1

1

1 2

2 3

3 4

4 5

5 6

6 7

7