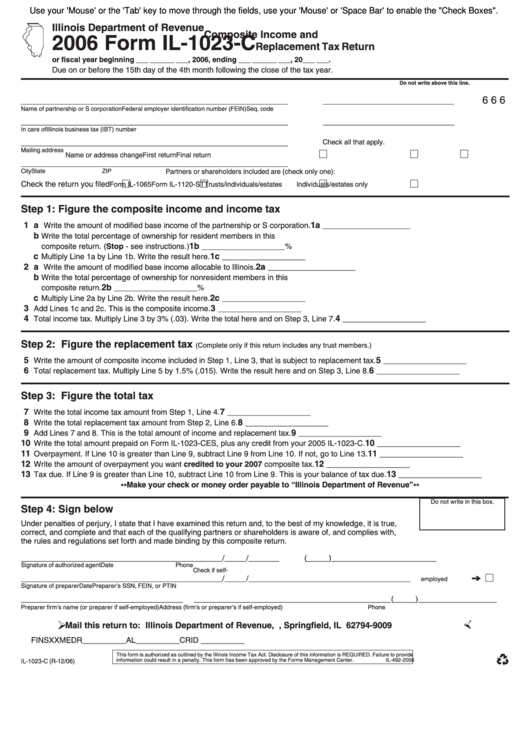

Use your 'Mouse' or the 'Tab' key to move through the fields, use your 'Mouse' or 'Space Bar' to enable the "Check Boxes".

Illinois Department of Revenue

Composite Income and

2006 Form IL-1023-C

Replacement Tax Return

or fiscal year beginning ___ ______ ___, 2006, ending ___ ______ ___, 20___ ___.

Due on or before the 15th day of the 4th month following the close of the tax year.

Do not write above this line.

6 6 6

_____________________________________________________________

______________________________

Name of partnership or S corporation

Federal employer identification number (FEIN)

Seq. code

_____________________________________________________________

______________________________

In care of

Illinois business tax (IBT) number

_____________________________________________________________

Check all that apply.

Mailing address

Name or address change

First return

Final return

_____________________________________________________________

City

State

ZIP

Partners or shareholders included are (check only one):

Check the return you filed

Form IL-1065

Form IL-1120-ST

Trusts/individuals/estates

Individuals/estates only

Step 1: Figure the composite income and income tax

1 a

1a

Write the amount of modified base income of the partnership or S corporation.

____________________

b

Write the total percentage of ownership for resident members in this

1b

composite return. (Stop - see instructions.)

___________________%

c

1c

Multiply Line 1a by Line 1b. Write the result here.

___________________

2 a

2a

Write the amount of modified base income allocable to Illinois.

____________________

b

Write the total percentage of ownership for nonresident members in this

2b

composite return.

___________________%

c

2c

Multiply Line 2a by Line 2b. Write the result here.

___________________

3

3

Add Lines 1c and 2c. This is the composite income.

___________________

4

4

Total income tax. Multiply Line 3 by 3% (.03). Write the total here and on Step 3, Line 7.

___________________

Step 2: Figure the replacement tax

(Complete only if this return includes any trust members.)

5

5

Write the amount of composite income included in Step 1, Line 3, that is subject to replacement tax.

___________________

6

6

Total replacement tax. Multiply Line 5 by 1.5% (.015). Write the result here and on Step 3, Line 8.

___________________

Step 3: Figure the total tax

7

7

Write the total income tax amount from Step 1, Line 4.

___________________

8

8

Write the total replacement tax amount from Step 2, Line 6.

___________________

9

9

Add Lines 7 and 8. This is the total amount of income and replacement tax.

___________________

10

10

Write the total amount prepaid on Form IL-1023-CES, plus any credit from your 2005 IL-1023-C.

___________________

11

11

Overpayment. If Line 10 is greater than Line 9, subtract Line 9 from Line 10. If not, go to Line 13.

___________________

12

12

Write the amount of overpayment you want credited to your 2007 composite tax.

___________________

13

13

Tax due. If Line 9 is greater than Line 10, subtract Line 10 from Line 9. This is your balance of tax due.

___________________

** Make your check or money order payable to “Illinois Department of Revenue” **

Do not write in this box.

Step 4: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true,

correct, and complete and that each of the qualifying partners or shareholders is aware of, and complies with,

the rules and regulations set forth and made binding by this composite return.

______________________________________________/_____/_______

(_____)________________________

Signature of authorized agent

Date

Phone

Check if self-

______________________________________________/_____/_______

______________________________

employed

Signature of preparer

Date

Preparer's SSN, FEIN, or PTIN

_____________________________________

_____________________________________________

(_____)__________________

Preparer firm's name (or preparer if self-employed)

Address (firm's or preparer's if self-employed)

Phone

Mail this return to: Illinois Department of Revenue, P.O. Box 19009, Springfield, IL 62794-9009

FI

NS

XX

ME

DR__________

AL__________

CR

ID __________

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to provide

information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-2056

IL-1023-C (R-12/06)

1

1 2

2