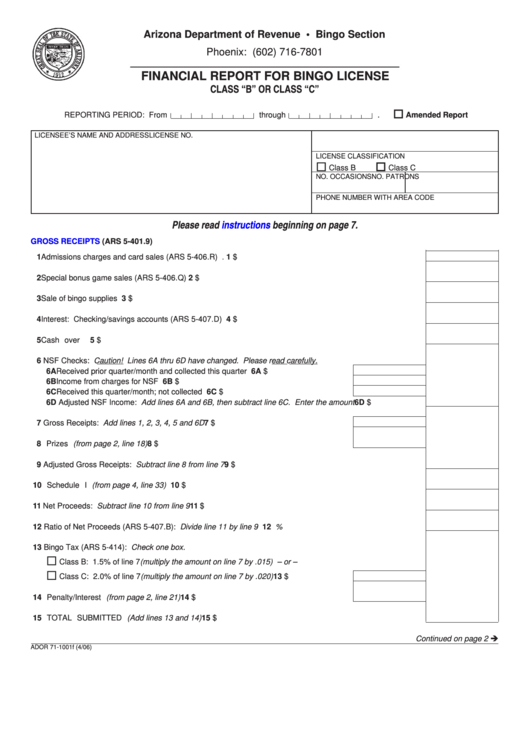

Arizona Department of Revenue • Bingo Section

Phoenix: (602) 716-7801

FINANCIAL REPORT FOR BINGO LICENSE

CLASS “B” OR CLASS “C”

REPORTING PERIOD: From

through

.

Amended Report

LICENSEE’S NAME AND ADDRESS

LICENSE NO.

LICENSE CLASSIFICATION

Class B

Class C

NO. OCCASIONS

NO. PATRONS

PHONE NUMBER WITH AREA CODE

Please read

instructions

beginning on page 7.

GROSS RECEIPTS

(ARS 5-401.9)

1 Admissions charges and card sales (ARS 5-406.R) ...............................................................................

1

$

2 Special bonus game sales (ARS 5-406.Q)..............................................................................................

2

$

3 Sale of bingo supplies .............................................................................................................................

3

$

4 Interest: Checking/savings accounts (ARS 5-407.D) .............................................................................

4

$

5 Cash over ................................................................................................................................................

5

$

6 NSF Checks: Caution! Lines 6A thru 6D have changed. Please read carefully.

6A

Received prior quarter/month and collected this quarter ................................

6A $

6B

Income from charges for NSF checks.............................................................

6B $

6C

Received this quarter/month; not collected .....................................................

6C $

6D

Adjusted NSF Income: Add lines 6A and 6B, then subtract line 6C. Enter the amount ................

6D $

7 Gross Receipts: Add lines 1, 2, 3, 4, 5 and 6D ....................................................

7

$

8 Prizes (from page 2, line 18) .................................................................................

8

$

9 Adjusted Gross Receipts: Subtract line 8 from line 7 .............................................................................

9

$

10 Schedule I (from page 4, line 33) ............................................................................................................

10

$

11 Net Proceeds: Subtract line 10 from line 9 .............................................................................................

11

$

12 Ratio of Net Proceeds (ARS 5-407.B): Divide line 11 by line 9 ..............................................................

12

%

13 Bingo Tax (ARS 5-414): Check one box.

Class B: 1.5% of line 7 (multiply the amount on line 7 by .015) – or –

Class C: 2.0% of line 7 (multiply the amount on line 7 by .020) .....................

13

$

14 Penalty/Interest (from page 2, line 21) ..................................................................

14

$

15 TOTAL SUBMITTED (Add lines 13 and 14) ............................................................................................

15

$

Continued on page 2

ADOR 71-1001f (4/06)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8