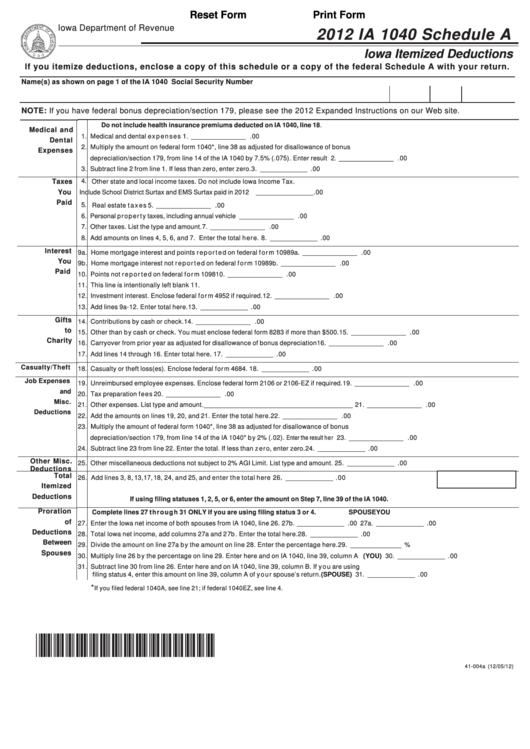

Reset Form

Print Form

Iowa Department of Revenue

2012 IA 1040 Schedule A

Iowa Itemized Deductions

If you itemize deductions, enclose a copy of this schedule or a copy of the federal Schedule A with your return.

Name(s) as shown on page 1 of the IA 1040

Social Security Number

NOTE: If you have federal bonus depreciation/section 179, please see the 2012 Expanded Instructions on our Web site.

Do not include health insurance premiums deducted on IA 1040, line 18.

Medical and

1. Medical and dental ex p e n s e s ............................................................................................... 1. _______________ .00

Dental

2. Multiply the amount on federal form 1040*, line 38 as adjusted for disallowance of bonus

Expenses

depreciation/section 179, from line 14 of the IA 1040 by 7.5% (.075). Enter result here... ..... 2. _______________ .00

3. Subtract line 2 from line 1. If less than zero, enter zero. ........................................................................................................ 3. _____________ .00

4.

Taxes

Other state and local income taxes. Do not include Iowa Income Tax.

You

Include School District Surtax and EMS Surtax paid in 2012 ....................................................4. _______________.00

Paid

5.

Real estate t a x e s ................................................................................................................... 5. _______________ .00

6. Personal pro p er t y taxes, including annual vehicle registration................................................ 6. _______________ .00

7. Other taxes. List the type and amount. .................................................................................... 7. _______________ .00

8. Add amounts on lines 4, 5, 6, and 7. Enter the total here. ................................................................................................... 8. _____________ .00

Interest

9a. Home mortgage interest and points r e p o r t e d on federal f o r m 1098 ................................. 9a. _______________ .00

You

9b. Home mortgage interest not r e p o r t e d on federal f o r m 1098 .............................................. 9b. _______________ .00

Paid

10. Points not r e p o r t e d on federal f o r m 1098 ........................................................................... 10. _______________ .00

11. This line is intentionally left blank .......................................................................................... 11.

12. Investment interest. Enclose federal f o r m 4952 if required. ................................................. 12. _______________ .00

13. Add lines 9a-12. Enter total here. .......................................................................................................................................... 13. _____________ .00

Gifts

14. Contributions by cash or check. ............................................................................................. 14. _______________ .00

to

15. Other than b y cash or check. You must enclose federal form 8283 if more than $500. ....... 15. _______________ .00

Charity

16. Carryover from prior year as adjusted for disallowance of bonus depreciation ................... 16. _______________ .00

17. Add lines 14 through 16. Enter total here. ............................................................................................................................. 17. _____________ .00

Casualty/Theft

18. Casualty or theft loss(es). Enclose federal form 4684. ......................................................................................................... 18. _____________ .00

Job Expenses

19. Unreimbursed employee expenses. Enclose federal form 2106 or 2106-EZ if required. .... 19. _______________ .00

and

20. Tax preparation fees .............................................................................................................. 20. _______________ .00

Misc.

21. Other expenses. List type and amount. _________________________________________ 21. _______________ .00

Deductions

22. Add the amounts on lines 19, 20, and 21. Enter the total here. ............................................ 22. _______________ .00

23. Multiply the amount of federal form 1040*, line 38 as adjusted for disallowance of bonus

depreciation/section 179, from line 14 of the IA 1040* b y 2% (.02). Enter the result here... ..... 23. _______________ .00

24. Subtract line 23 from line 22. Enter the total. If less than z e r o, enter zero. .......................................................................... 24. _____________ .00

Other Misc.

25. Other miscellaneous deductions not subject to 2% AGI Limit. List type and amount. .......................................................... 25. _____________ .00

Deductions

Total

26. Add lines 3, 8, 13, 17, 18, 24, and 25, and enter the total here .....................................................................................

26. _____________ .00

Itemized

Deductions

If using filing statuses 1, 2, 5, or 6, enter the amount on Step 7, line 39 of the IA 1040.

Proration

Complete lines 27 throug h 31 ONLY if you are using filing status 3 or 4.

SPOUSE

YOU

of

27. Enter the Iowa net income of both spouses from IA 1040, line 26. .......................................... 27b. _____________ .00 27a. _____________ .00

Deductions

28. Total Iowa net income, add columns 27a and 2 7b . Enter the total here. ............................................................................. 28. _____________ .00

Between

29. Divide the amount on line 27a b y the amount on line 28. Enter the percentage here. ........................................................ 29. ______________ %

Spouses

30. Multiply line 26 b y the percentage on line 29. Enter here and on IA 1040, line 39, column A ............................. (YOU) 30. _____________ .00

31. Subtract line 30 from line 26. Enter here and on IA 1040, line 39, column B. If y o u are using

filing status 4, enter this amount on line 39, column A of y o u r spouse’s return. .............................................. (SPOUSE) 31. _____________ .00

*

If you filed federal 1040A, see line 21; if federal 1040EZ, see line 4.

*1241004019999*

41-004a (12/05/12)

1

1 2

2