Form Pit-4 - New Mexico Preservation Of Cultural Property Credit (Personal Income Tax) - 2015 Page 2

ADVERTISEMENT

State of New Mexico - Taxation and Revenue Department

Rev. 06/29/2015

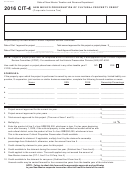

2015 PIT-4

NEW MEXICO PRESERVATION OF CULTURAL PROPERTY CREDIT

(Personal Income Tax) INSTRUCTIONS

page 1 of 2

ABOUT THIS CREDIT: The credit for preservation of cultural property is 50% of the approved eligible costs of a project

for the restoration, rehabilitation or preservation of cultural properties listed on the official New Mexico Register of Cultural

Properties, not to exceed $25,000. For tax years beginning on or after January 1, 2009, if the property is also certified by

the state coordinator of the New Mexico Arts and Cultural Districts as located within the boundaries of a state-certified or

municipally-certified arts and cultural district, pursuant to the Arts and Cultural District Act, a maximum of $50,000 credit

will be allowed. Any portion of the credit that remains unused at the end of the taxpayer's reporting period may be carried

forward for four consecutive years.

A taxpayer who files a New Mexico personal income tax return and who is not a dependent of another individual and who is

the owner of the cultural property may claim the credit. A member/owner of a partnership, LLC, S corporation, joint venture

or similar business association that has qualified for the preservation of cultural properties credit may claim the credit in

proportion to the taxpayer's interest in the business association. The member/owner must complete Schedule A.

A taxpayer may claim this credit if:

1. The taxpayer submitted a plan and specifications for restoration, rehabilitation, or preservation to the Cultural Properties

Review Committee (CPRC) and received approval from the CPRC for the plan and specifications prior to commence-

ment of the restoration, rehabilitation, or preservation;

2. The taxpayer received certification from the CPRC after completing the restoration, rehabilitation, or preservation, or

committee-approved phase, that it conformed to the plan and specifications and preserved and maintained those quali-

ties of the property that made it eligible for inclusion in the official register; and

3. The project is completed within 24 months of the date the project is approved by the CPRC.

Married individuals who file separate returns for a reporting period in which they could have filed a joint return may each

claim only one-half of the credit that would have been allowed on a joint return.

HOW TO COMPLETE THIS FORM: Complete all information requested in the address block. Enter the dates part 1 and

part 2 were approved and the total amount approved for the project or project phase. Enter the Credit Approval Number, or

the log number shown on the project approval document issued to you by the Historic Preservation Division.

Part 1 approval is CPRC's approval of the plan and specifications. Part 2 approval is CPRC's certification of completion in

conformity with the plan and specifications. Both approvals must be obtained before claiming this credit.

Schedule A. Complete this section if the project is owned by one or more members/owners of a partnership, limited liability

corporation, S corporation, joint venture or similar business association. If additional space is needed, attach a separate

page.

Line 1.

Enter amount of the project or the comittee-approved project phase that was approved for the current tax year.

Line 2.

Enter amount approved for the project in prior tax years, if applicable.

Line 3.

Enter the sum of lines 1 and 2. This is the total amount approved for this project.

Line 4.

Multiply line 3 by 50%.

Line 5.

Enter the product of line 3 x line 4 or $25,000 whichever is less. For tax years beginning on or after January 1,

2009, if the property is also certified by the state coordinator of New Mexico arts and cultural districts as being

located within the boundaries of a state-certified or municipally-certified arts and cultural district, enter the

product of line 3 x line 4 or $50,000, whichever is less.

Line 6.

Credit allowed for claimant. If applicable, multiply line 5 by the claimant's ownership percentage from Schedule

A. If one or more members/owners of a partnership, limited liability corporation, S corporation, joint venture or

similar business association, the claimant may only claim an amount of a credit in proportion to the claimant's

interest in the business association. The claimant is the taxpayer who is filing the New Mexico income tax return

and claiming the credit on their return.

Line 7.

Credit claimed by the claimant in prior years for this project. Enter the amount of credit claimed in previous

years, for this project.

Line 8.

Credit available to the claimant during the current tax year. Subtract line 7 from line 6.

Line 9.

Credit applied to the current tax year. The credit applied to the current tax year, cannot exceed line 8, or the

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3