Form Et-117 - Release Of Lien Of Estate Tax

ADVERTISEMENT

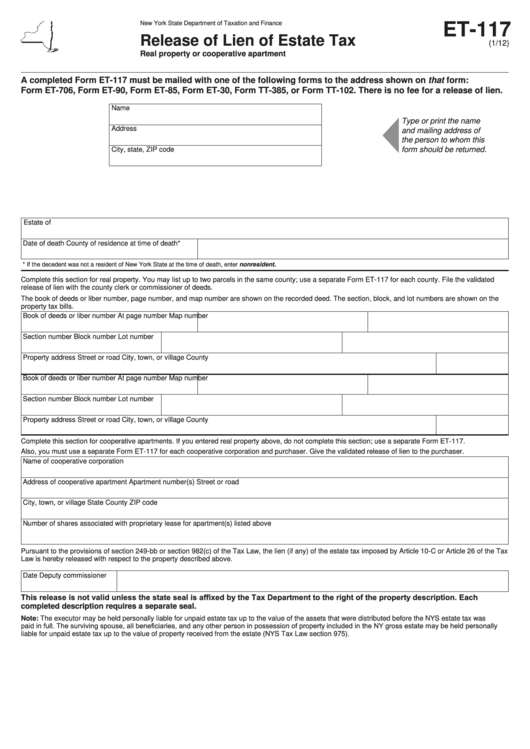

New York State Department of Taxation and Finance

ET-117

Release of Lien of Estate Tax

(1/12)

Real property or cooperative apartment

A completed Form ET-117 must be mailed with one of the following forms to the address shown on that form:

Form ET-706, Form ET-90, Form ET-85, Form ET-30, Form TT-385, or Form TT-102. There is no fee for a release of lien.

Name

Type or print the name

Address

and mailing address of

the person to whom this

form should be returned.

City, state, ZIP code

Estate of

Date of death

County of residence at time of death*

* If the decedent was not a resident of New York State at the time of death, enter nonresident.

Complete this section for real property. You may list up to two parcels in the same county; use a separate Form ET-117 for each county. File the validated

release of lien with the county clerk or commissioner of deeds.

The book of deeds or liber number, page number, and map number are shown on the recorded deed. The section, block, and lot numbers are shown on the

property tax bills.

Book of deeds or liber number

At page number

Map number

Section number

Block number

Lot number

Property address

Street or road

City, town, or village County

Book of deeds or liber number

At page number

Map number

Section number

Block number

Lot number

Property address

Street or road

City, town, or village County

Complete this section for cooperative apartments. If you entered real property above, do not complete this section; use a separate Form ET-117.

Also, you must use a separate Form ET-117 for each cooperative corporation and purchaser. Give the validated release of lien to the purchaser.

Name of cooperative corporation

Address of cooperative apartment

Apartment number(s)

Street or road

City, town, or village

State

County

ZIP code

Number of shares associated with proprietary lease for apartment(s) listed above

Pursuant to the provisions of section 249-bb or section 982(c) of the Tax Law, the lien (if any) of the estate tax imposed by Article 10-C or Article 26 of the Tax

Law is hereby released with respect to the property described above.

Date

Deputy commissioner

This release is not valid unless the state seal is affixed by the Tax Department to the right of the property description. Each

completed description requires a separate seal.

Note: The executor may be held personally liable for unpaid estate tax up to the value of the assets that were distributed before the NYS estate tax was

paid in full. The surviving spouse, all beneficiaries, and any other person in possession of property included in the NY gross estate may be held personally

liable for unpaid estate tax up to the value of property received from the estate (NYS Tax Law section 975).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1