Form Et-411 - Computation Of Estate Tax Credit For Agricultural Exemption

ADVERTISEMENT

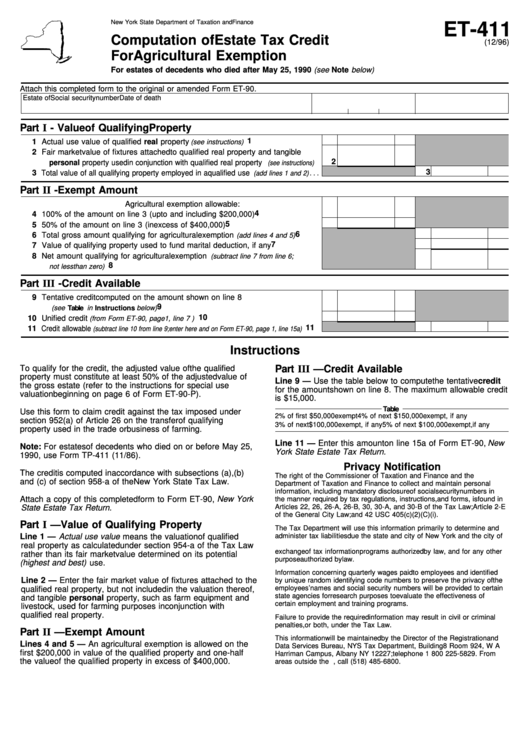

New York State Department of Taxation and Finance

ET-411

Computation of Estate Tax Credit

(12/96)

For Agricultural Exemption

For estates of decedents who died after May 25, 1990 (see Note below)

Attach this completed form to the original or amended Form ET-90.

Estate of

Social security number

Date of death

Part I - Value of Qualifying Property

1

1 Actual use value of qualified real property

. . . . . . . . . . . . . . . . . . . . .

(see instructions)

2 Fair market value of fixtures attached to qualified real property and tangible

2

personal property used in conjunction with qualified real property

(see instructions)

3

3 Total value of all qualifying property employed in a qualified use

. . .

(add lines 1 and 2)

Part II - Exempt Amount

Agricultural exemption allowable:

4

4 100% of the amount on line 3 (up to and including $200,000) . . . . . . . . . . . . . . . . .

5

5 50% of the amount on line 3 (in excess of $400,000) . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6 Total gross amount qualifying for agricultural exemption

. . . . . . .

(add lines 4 and 5)

7

7 Value of qualifying property used to fund marital deduction, if any . . . . . . . . . . . . .

8 Net amount qualifying for agricultural exemption

(subtract line 7 from line 6;

8

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

not less than zero)

Part III - Credit Available

9 Tentative credit computed on the amount shown on line 8

9

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(see Table in Instructions below)

10

10 Unified credit

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(from Form ET-90, page 1, line 7 )

11

11 Credit allowable

. . . .

(subtract line 10 from line 9; enter here and on Form ET-90, page 1, line 15a)

Instructions

To qualify for the credit, the adjusted value of the qualified

Part III — Credit Available

property must constitute at least 50% of the adjusted value of

Line 9 — Use the table below to compute the tentative credit

the gross estate (refer to the instructions for special use

for the amount shown on line 8. The maximum allowable credit

valuation beginning on page 6 of Form ET-90-P).

is $15,000.

Table

Use this form to claim credit against the tax imposed under

2% of first $50,000 exempt

4% of next $150,000 exempt, if any

section 952(a) of Article 26 on the transfer of qualifying

3% of next $100,000 exempt, if any

5% of next $100,000 exempt, if any

property used in the trade or business of farming.

Line 11 — Enter this amount on line 15a of Form ET-90, New

Note: For estates of decedents who died on or before May 25,

York State Estate Tax Return.

1990, use Form TP-411 (11/86).

Privacy Notification

The credit is computed in accordance with subsections (a), (b)

The right of the Commissioner of Taxation and Finance and the

and (c) of section 958-a of the New York State Tax Law.

Department of Taxation and Finance to collect and maintain personal

information, including mandatory disclosure of social security numbers in

Attach a copy of this completed form to Form ET-90, New York

the manner required by tax regulations, instructions, and forms, is found in

State Estate Tax Return.

Articles 22, 26, 26-A, 26-B, 30, 30-A, and 30-B of the Tax Law; Article 2-E

of the General City Law; and 42 USC 405(c)(2)(C)(i).

Part I — Value of Qualifying Property

The Tax Department will use this information primarily to determine and

Line 1 — Actual use value means the valuation of qualified

administer tax liabilities due the state and city of New York and the city of

Yonkers. We will also use this information for certain tax offset and

real property as calculated under section 954-a of the Tax Law

exchange of tax information programs authorized by law, and for any other

rather than its fair market value determined on its potential

purpose authorized by law.

(highest and best) use.

Information concerning quarterly wages paid to employees and identified

Line 2 — Enter the fair market value of fixtures attached to the

by unique random identifying code numbers to preserve the privacy of the

employees’ names and social security numbers will be provided to certain

qualified real property, but not included in the valuation thereof,

state agencies for research purposes to evaluate the effectiveness of

and tangible personal property, such as farm equipment and

certain employment and training programs.

livestock, used for farming purposes in conjunction with

qualified real property.

Failure to provide the required information may result in civil or criminal

penalties, or both, under the Tax Law.

Part II — Exempt Amount

This information will be maintained by the Director of the Registration and

Lines 4 and 5 — An agricultural exemption is allowed on the

Data Services Bureau, NYS Tax Department, Building 8 Room 924, W A

first $200,000 in value of the qualified property and one-half

Harriman Campus, Albany NY 12227; telephone 1 800 225-5829. From

the value of the qualified property in excess of $400,000.

areas outside the U.S. and outside Canada, call (518) 485-6800.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1