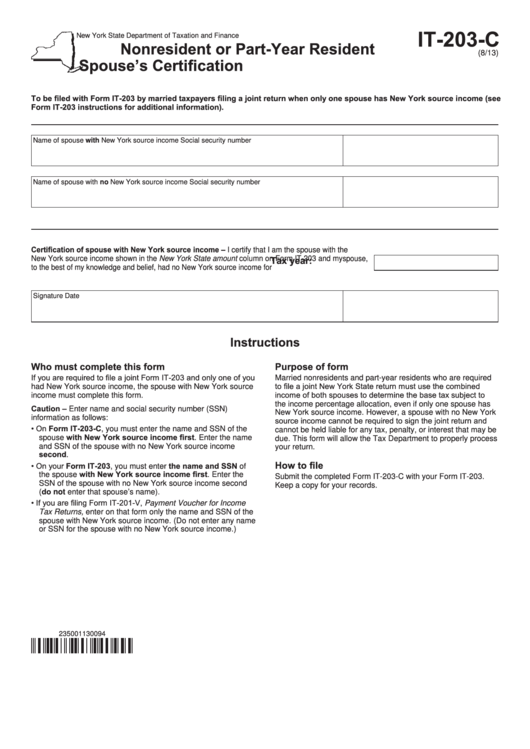

IT-203-C

New York State Department of Taxation and Finance

Nonresident or Part-Year Resident

(8/13)

Spouse’s Certification

To be filed with Form IT-203 by married taxpayers filing a joint return when only one spouse has New York source income (see

Form IT-203 instructions for additional information).

Name of spouse with New York source income

Social security number

Name of spouse with no New York source income

Social security number

Certification of spouse with New York source income – I certify that I am the spouse with the

New York source income shown in the New York State amount column on Form IT-203 and my spouse,

Tax year:

to the best of my knowledge and belief, had no New York source income for .............................................

Signature

Date

Instructions

Who must complete this form

Purpose of form

If you are required to file a joint Form IT-203 and only one of you

Married nonresidents and part-year residents who are required

to file a joint New York State return must use the combined

had New York source income, the spouse with New York source

income of both spouses to determine the base tax subject to

income must complete this form.

the income percentage allocation, even if only one spouse has

Caution – Enter name and social security number (SSN)

New York source income. However, a spouse with no New York

information as follows:

source income cannot be required to sign the joint return and

• On Form IT-203-C, you must enter the name and SSN of the

cannot be held liable for any tax, penalty, or interest that may be

spouse with New York source income first. Enter the name

due. This form will allow the Tax Department to properly process

and SSN of the spouse with no New York source income

your return.

second.

How to file

• On your Form IT-203, you must enter the name and SSN of

the spouse with New York source income first. Enter the

Submit the completed Form IT-203-C with your Form IT-203.

SSN of the spouse with no New York source income second

Keep a copy for your records.

(do not enter that spouse’s name).

• If you are filing Form IT-201-V, Payment Voucher for Income

Tax Returns, enter on that form only the name and SSN of the

spouse with New York source income. (Do not enter any name

or SSN for the spouse with no New York source income.)

235001130094

1

1