Page 6 of 7 IT-2104 (2015)

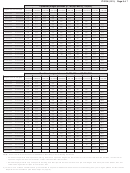

These charts are only for single taxpayers and head of household taxpayers with more than one job, and whose combined

Part 5 –

wages are between $106,200 and $2,231,827.

Enter the additional withholding dollar amount on line 3.

The additional dollar amount, as shown below, is accurate for a weekly payroll. If you are not paid on a weekly basis, you will need to

adjust these dollar amount(s). For example, if you are paid biweekly, you must double the dollar amount(s) computed.

Combined wages between $106,200 and $531,299

$106,200 $127,500

$148,700 $169,950 $191,200 $233,700

$276,250 $318,750 $371,900 $425,050 $478,200

Higher wage

$127,499 $148,699

$169,949 $191,199 $233,699 $276,249

$318,749 $371,899 $425,049 $478,199 $531,299

$53,100

$74,299

$13

$18

$74,300

$95,549

$12

$19

$26

$25

$95,550

$116,799

$8

$16

$23

$26

$27

$116,800

$127,499

$2

$11

$18

$21

$25

$28

$127,500

$138,099

$4

$15

$18

$22

$28

$138,100

$148,699

$2

$11

$14

$19

$28

$26

$148,700

$159,349

$4

$11

$15

$27

$24

$159,350

$170,149

$2

$8

$13

$26

$25

$21

$170,150

$191,199

$3

$11

$25

$27

$22

$24

$191,200

$233,699

$8

$20

$29

$26

$24

$18

$233,700

$276,249

$8

$15

$23

$18

$18

$12

$276,250

$318,749

$7

$15

$22

$15

$16

$318,750

$371,899

$8

$16

$22

$14

$371,900

$425,049

$8

$16

$22

$425,050

$478,199

$8

$16

$478,200

$531,299

$8

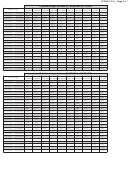

Combined wages between $531,300 and $1,168,949

$531,300

$584,450

$637,600

$690,700

$743,850

$797,000

$850,150

$903,300

$956,450 $1,009,550 $1,062,650 $1,115,850

Higher wage

$584,449

$637,599

$690,699

$743,849

$796,999

$850,149

$903,299

$956,449 $1,009,549 $1,062,649 $1,115,849 $1,168,949

$233,700

$276,249

$9

$276,250

$318,749

$9

$8

$318,750

$371,899

$16

$8

$8

$8

$371,900

$425,049

$14

$16

$8

$8

$8

$8

$425,050

$478,199

$22

$14

$16

$8

$8

$8

$8

$8

$478,200

$531,299

$16

$22

$14

$16

$8

$8

$8

$8

$8

$8

$531,300

$584,449

$8

$16

$22

$14

$16

$8

$8

$8

$8

$8

$222

$446

$584,450

$637,599

$8

$16

$22

$14

$16

$8

$8

$8

$8

$222

$446

$637,600

$690,699

$8

$16

$22

$14

$16

$8

$8

$8

$222

$446

$690,700

$743,849

$8

$16

$22

$14

$16

$8

$8

$222

$446

$743,850

$796,999

$8

$16

$22

$14

$16

$8

$222

$446

$797,000

$850,149

$8

$16

$22

$14

$16

$222

$446

$850,150

$903,299

$8

$16

$22

$14

$230

$446

$903,300

$956,449

$8

$16

$22

$228

$454

$956,450

$1,009,549

$8

$16

$235

$452

$1,009,550

$1,062,649

$8

$229

$460

$1,062,650

$1,115,849

$114

$240

$1,115,850

$1,168,949

$14

(Part 5 continued on page 7)

Privacy notification

Need help?

The Commissioner of Taxation and Finance may collect and maintain personal

information pursuant to the New York State Tax Law, including but not limited to,

Visit our Web site at

sections 5-a, 171, 171-a, 287, 308, 429, 475, 505, 697, 1096, 1142, and 1415

• get information and manage your taxes online

of that Law; and may require disclosure of social security numbers pursuant to

42 USC 405(c)(2)(C)(i).

• check for new online services and features

This information will be used to determine and administer tax liabilities and, when

authorized by law, for certain tax offset and exchange of tax information programs

Telephone assistance

as well as for any other lawful purpose.

Automated income tax refund status:

(518) 457-5149

Information concerning quarterly wages paid to employees is provided to certain

state agencies for purposes of fraud prevention, support enforcement, evaluation of

Personal Income Tax Information Center: (518) 457-5181

the effectiveness of certain employment and training programs and other purposes

authorized by law.

To order forms and publications:

(518) 457-5431

Failure to provide the required information may subject you to civil or criminal

penalties, or both, under the Tax Law.

Text Telephone (TTY) Hotline (for persons with

hearing and speech disabilities using a TTY): (518) 485-5082

This information is maintained by the Manager of Document Management, NYS Tax

Department, W A Harriman Campus, Albany NY 12227; telephone (518) 457-5181.

1

1 2

2 3

3 4

4 5

5 6

6 7

7