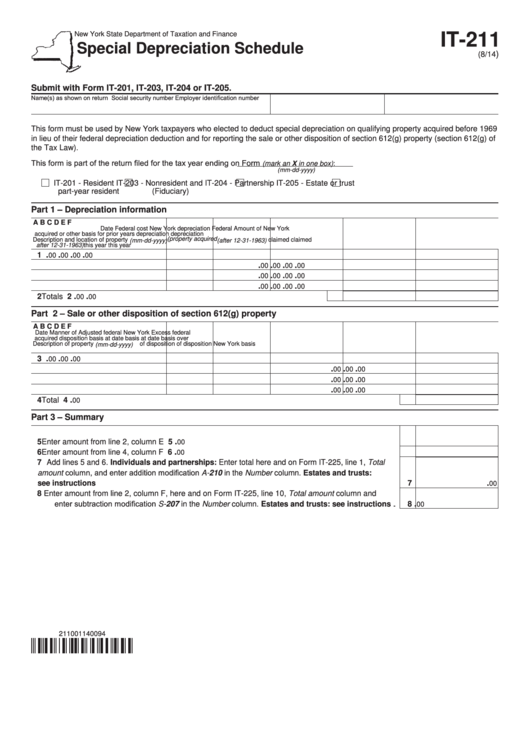

New York State Department of Taxation and Finance

IT-211

Special Depreciation Schedule

)

(8/14

Submit with Form IT-201, IT-203, IT-204 or IT-205.

Name(s) as shown on return

Social security number

Employer identification number

This form must be used by New York taxpayers who elected to deduct special depreciation on qualifying property acquired before 1969

in lieu of their federal depreciation deduction and for reporting the sale or other disposition of section 612(g) property (section 612(g) of

the Tax Law).

This form is part of the return filed for the tax year ending

on Form

(mark an X in one box):

(mm-dd-yyyy)

IT-201 - Resident

IT-203 - Nonresident and

IT-204 - Partnership

IT-205 - Estate or trust

part-year resident

(Fiduciary)

Part 1 – Depreciation information

A

B

C

D

E

F

Date

Federal cost

New York depreciation

Federal

Amount of New York

acquired

or other basis

for prior years

depreciation

depreciation

(property acquired

Description and location of property

claimed

claimed

(mm-dd-yyyy)

(after 12-31-1963)

after 12-31-1963)

this year

this year

.

.

.

.

1

00

00

00

00

.

.

.

.

00

00

00

00

.

.

.

.

00

00

00

00

.

.

.

.

00

00

00

00

.

.

2 Totals .....................................................................................................................

2

00

00

Part 2 – Sale or other disposition of section 612(g) property

A

B

C

D

E

F

Date

Manner of

Adjusted federal

New York

Excess federal

acquired

disposition

basis at date

basis at date

basis over

Description of property

of disposition

of disposition

New York basis

(mm-dd-yyyy)

.

.

.

3

00

00

00

.

.

.

00

00

00

.

.

.

00

00

00

.

.

.

00

00

00

.

4 Total ..........................................................................................................................................................

4

00

Part 3 – Summary

.

5 Enter amount from line 2, column E .........................................................................................................

5

00

.

6 Enter amount from line 4, column F .........................................................................................................

6

00

7 Add lines 5 and 6. Individuals and partnerships: Enter total here and on Form IT-225, line 1, Total

amount column, and enter addition modification A-210 in the Number column. Estates and trusts:

.

see instructions .....................................................................................................................................

7

00

8 Enter amount from line 2, column F, here and on Form IT-225, line 10, Total amount column and

enter subtraction modification S-207 in the Number column. Estates and trusts: see instructions ..

.

8

00

211001140094

1

1