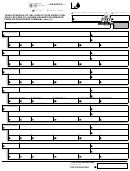

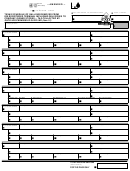

Form 06-155(Back)(Rev.3-06/3)

TEXAS SCHEDULE OF GALLONS OF DYED DIESEL FUEL

SOLD TAX-FREE TO LICENSE HOLDERS OR REMOVED BY

SUPPLIER FROM IRS REGISTERED TERMINAL

(Item 13)

You have certain rights under Chapters 552 and 559, Government Code, to review, request, and correct information

we have on file about you. Contact us at the address or toll-free number listed on this form.

WHO MUST FILE

Every licensed supplier, permissive supplier, distributor, or distributor/aviation fuel dealer that sells dyed diesel fuel to another

licensed supplier, permissive supplier, distributor, distributor/aviation fuel dealer, importer/dyed diesel fuel bonded user or dyed

diesel fuel bonded user must file this schedule. Failure to file this schedule may result in collection action as prescribed by Title 2

of the Tax Code.

FOR ASSISTANCE

For assistance with any Texas Fuels tax questions, please contact the Texas State Comptroller's Office at 1-800-252-1383

toll-free nationwide, or call 512-463-4600.

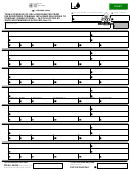

GENERAL INSTRUCTIONS

Please write only in white areas.

TYPE or PRINT all information

Complete all applicable items that are not preprinted.

If any preprinted information is not correct, mark out the incorrect item and write in the correct information.

ROUND ALL GALLONAGE FIGURES TO WHOLE GALLONS.

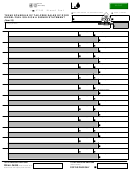

SPECIFIC INSTRUCTIONS

Item 1 - Enter the name of the transporter.

Item 2 - Enter the 11-digit taxpayer number of the transporter of the fuel.

Item 3 - Enter the name of the purchaser.

Item 4 -

Enter the 11-digit taxpayer number of the purchaser of the fuel.

Item 5- Enter the three-digit product type.

228 - Dyed Diesel Fuel

072 - Dyed Kerosene.

Item 6 - Enter a valid character for mode of transportation. Use one of the following:

S = Ship

J = Truck

BA = Book Adjustment

R = Rail

ST = Stationary Transfer

B = Barge

PL = Pipeline

Item 7 - Enter the date, MM/DD/YY, as it appears on the Shipping Document/Bill of Lading. This is the date the fuel was

PHYSICALLY REMOVED from a terminal or bulk plant. May be left blank if summarizing transactions. See item #8.

Item 8 - Enter the Shipping Document/Bill of Lading number. This is the identifying number from the document issued at the

terminal or bulk plant when the product is removed. In the case of pipeline or barge movements, enter the pipeline or

barge ticket number. You may report the summary of multiple transactions when the transporter, product type, the

purchaser, and the terminal control number (if applicable) are the same. Enter the word 'SUM.' You must maintain

detailed records of the transactions reported as a summary.

Item 9 - Enter the terminal control number of the facility from which the fuel was removed. May be left blank if the motor fuel is

removed from a non-IRS registered bulk plant.

Item 10 - Enter invoiced gallons. You may report the summary of multiple transactions. See item #8.

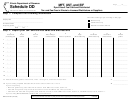

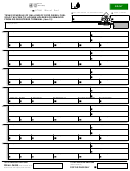

1

1 2

2