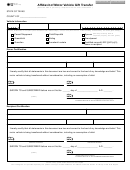

Form 14-317 (Back)(Rev.6-11/4)

Instructions for Filing Form 14-317, Affidavit of Motor Vehicle Gift Transfer

Who Must File –

This affidavit must be filed in person by either the recipient of the gift or the person from whom the gift is received. If

inherited, either the recipient or the person authorized to act on behalf of the estate must file the form.

A motor vehicle title service or Power of Attorney may not be used to file this affidavit.

Identification Required –

The person filing the affidavit must present one of the forms of identification documents listed below to the Tax Assessor-

Collector at the time of filing. The identification provided must be issued to and bear a photograph of the person filing the

affidavit and must be unexpired.

• a driver’s license or personal identification card issued by this state or another state of the United States;

• an original passport issued by the United States or a foreign country;

• an identification card or similar form of identification issued by the Texas Department of Criminal Justice;

• a United States Military identification card;

• or an identification card or document issued by the United States Department of Homeland Security or the United

States Citizenship and Immigration Services agency.

Eligible Gift Transfers –

To qualify to be taxed as a gift ($10), a vehicle must be received from the following eligible parties:

• spouse (separate property only–vehicles held as community property are not subject to the tax);

• parent or stepparent;

• father/mother-in-law or son/daughter-in-law;

• grandparent/grandparent-in-law or grandchild/grandchild-in-law;

• child or stepchild;

• sibling/brother-in-law/sister-in-law;

• guardian;

• decedent’s estate (inherited); or

• a nonprofit service organization qualifying under Section 501(c)(3), IRC (gift tax applies when the entity is either

the donor or recipient).

A motor vehicle received outside of Texas from an eligible donor may also qualify as a gift when brought into Texas.

All other motor vehicle transfers, including those made without payment of consideration, are defined as sales and may

be subject to Standard Presumptive Value (SPV) procedures. See Tax Code Sec. 152.0412, Standard Presumptive

Value; Use By Tax Assessor-Collector and Rule 3.79, Standard Presumptive Value.

Documenting Additional Eligible Donor Relationships –

The Parent/Stepparent check box applies also to a Father/Mother-in-Law gift; the Child/Stepchild check box applies also

to a Son/Daughter-in-Law gift; the Sibling check box applies also to a Brother/Sister-in-Law gift; and the Grandparent

check box applies also to a Grandparent-in-Law gift.

When and Where to File –

At time of title transfer with the County Tax Assessor-Collector. Do not send the completed form to the Comptroller of

Public Accounts.

Documents Required –

In addition to completing Application For Texas Certificate of Title, Form 130-U, both the donor and person receiving

the vehicle must complete Form 14-317, Affidavit of motor Vehicle Gift Transfer, describing the transaction and the

relationship between the donor and recipient.The county TAC or staff member may acknowledge the donor or recipient’s

signature in lieu of formal notarization, provided that the person whose signature is being acknowledged is present and

signs the affidavit in front of the county TAC or staff member. A notary from another state may notarize this document. A

faxed copy is acceptable documentation for one of the qualified parties.

If the gift transfer is the result of an inheritance, the executor should sign the gift affidavit as “donor.” If the transfer is

completed using an Affidavit of Heirship for a motor Vehicle (TxDMV-VTR262), only one heir is required to sign as donor.

When there are multiple donors or recipients signing, additional copies of Form 14-317 should be used to document

signatures and notary acknowledgements.

Questions –

If you have questions or need more information, contact the Comptroller’s office at (800) 252-1382 or email

tax.help@cpa.state.tx.us. Rule 3.80, Motor Vehicles Transferred as a Gift or for No Consideration, explains the law

and its provisions and is available on the Comptroller’s website at

1

1 2

2