Remember to print and sign your report.

b.

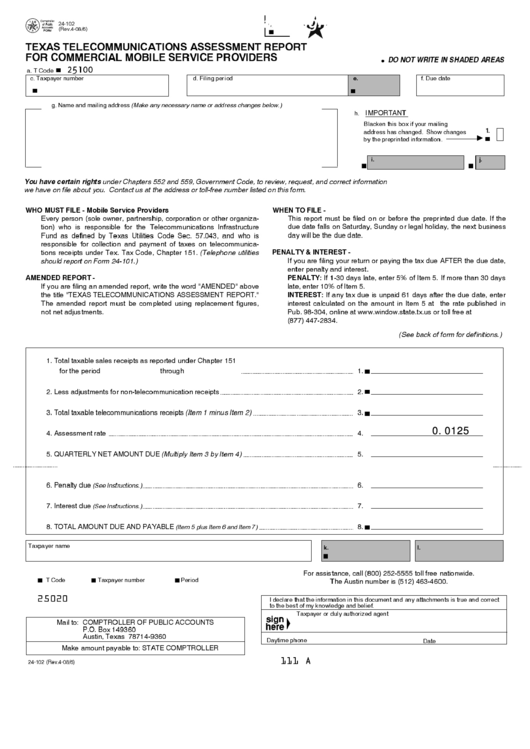

24-102

(Rev.4-08/6)

TEXAS TELECOMMUNICATIONS ASSESSMENT REPORT

FOR COMMERCIAL MOBILE SERVICE PROVIDERS

DO NOT WRITE IN SHADED AREAS

25100

a. T Code

c. Taxpayer number

d. Filing period

f. Due date

e.

g. Name and mailing address (Make any necessary name or address changes below.)

IMPORTANT

h.

Blacken this box if your mailing

address has changed. Show changes

1.

by the preprinted information.

i.

j.

You have certain rights under Chapters 552 and 559, Government Code, to review, request, and correct information

we have on file about you. Contact us at the address or toll-free number listed on this form.

WHO MUST FILE - Mobile Service Providers

WHEN TO FILE

Every person (sole owner, partnership, corporation or other organiza-

This report must be filed on or before the preprinted due date. If the

tion) who is responsible for the Telecommunications Infrastructure

due date falls on Saturday, Sunday or legal holiday, the next business

Fund as defined by Texas Utilities Code Sec. 57.043, and who is

day will be the due date.

responsible for collection and payment of taxes on telecommunica

PENALTY & INTEREST

tions receipts under Tex. Tax Code, Chapter 151. (Telephone utilities

If you are filing your return or paying the tax due AFTER the due date,

should report on Form 24-101.)

enter penalty and interest.

AMENDED REPORT

PENALTY: If 1-30 days late, enter 5% of Item 5. If more than 30 days

If you are filing an amended report, write the word "AMENDED" above

late, enter 10% of Item 5.

INTEREST: If any tax due is unpaid 61 days after the due date, enter

the title "TEXAS TELECOMMUNICATIONS ASSESSMENT REPORT."

The amended report must be completed using replacement figures,

interest calculated on the amount in Item 5 at the rate published in

not net adjustments.

Pub. 98-304, online at or toll free at

(877) 447-2834.

(See back of form for definitions.)

1. Total taxable sales receipts as reported under Chapter 151

for the period

through

1.

2. Less adjustments for non-telecommunication receipts

2.

3. Total taxable telecommunications receipts (Item 1 minus Item 2)

3.

0.0125

4. Assessment rate

4.

5. QUARTERLY NET AMOUNT DUE (Multiply Item 3 by Item 4)

5.

6. Penalty due

6.

(See Instructions.)

7. Interest due

7.

(See Instructions.)

8. TOTAL AMOUNT DUE AND PAYABLE

8.

(Item 5 plus Item 6 and Item 7)

Taxpayer name

k.

l.

For assistance, call (800) 252-5555 toll free nationwide.

T Code

Taxpayer number

Period

The Austin number is (512) 463-4600.

25020

I declare that the information in this document and any attachments is true and correct

to the best of my knowledge and belief.

Taxpayer or duly authorized agent

Mail to: COMPTROLLER OF PUBLIC ACCOUNTS

P.O. Box 149360

Austin, Texas 78714-9360

Daytime phone

Date

Make amount payable to: STATE COMPTROLLER

111 A

24-102 (Rev.4-08/6)

1

1 2

2