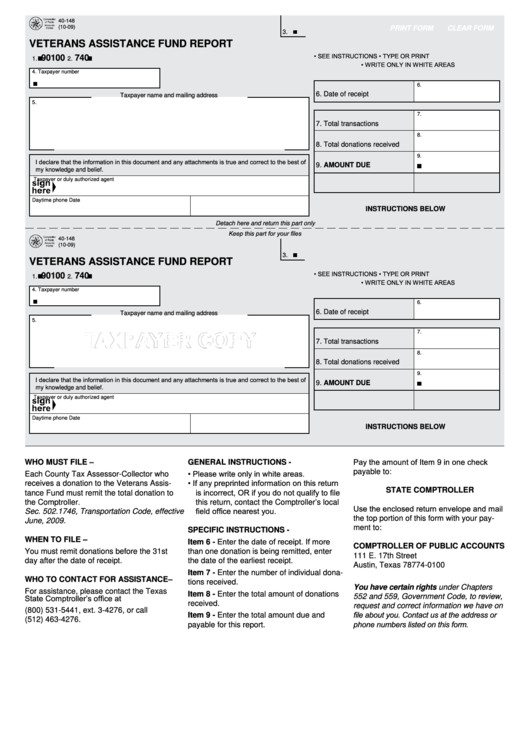

40-148

(10-09)

PRINT FORM

CLEAR FORM

3.

veterans assistance fund rePOrt

• SEE INSTRUCTIONS

• TYPE OR PRINT

90100

740

1.

2.

• WRITE ONLY IN WHITE AREAS

4. Taxpayer number

6.

6. Date of receipt

Taxpayer name and mailing address

5.

7.

7. Total transactions

8.

8. Total donations received

9.

I declare that the information in this document and any attachments is true and correct to the best of

9. aMOunt due

my knowledge and belief.

Taxpayer or duly authorized agent

Daytime phone

Date

instructiOns BeLOW

Detach here and return this part only

Keep this part for your files

40-148

(10-09)

3.

veterans assistance fund rePOrt

• SEE INSTRUCTIONS

• TYPE OR PRINT

90100

740

1.

2.

• WRITE ONLY IN WHITE AREAS

4. Taxpayer number

6.

6. Date of receipt

Taxpayer name and mailing address

5.

7.

taXPaYer cOPY

7. Total transactions

8.

8. Total donations received

9.

I declare that the information in this document and any attachments is true and correct to the best of

9. aMOunt due

my knowledge and belief.

Taxpayer or duly authorized agent

Daytime phone

Date

instructiOns BeLOW

Pay the amount of Item 9 in one check

WHO Must fiLe –

GeneraL instructiOns -

• Please write only in white areas.

payable to:

Each County Tax Assessor-Collector who

• If any preprinted information on this return

receives a donation to the Veterans Assis-

is incorrect, OR if you do not qualify to file

state cOMPtrOLLer

tance Fund must remit the total donation to

the Comptroller.

this return, contact the Comptroller’s local

Use the enclosed return envelope and mail

field office nearest you.

Sec. 502.1746, Transportation Code, effective

the top portion of this form with your pay-

June, 2009.

ment to:

sPecific instructiOns -

WHen tO fiLe –

item 6 - Enter the date of receipt. If more

cOMPtrOLLer Of PuBLic accOunts

You must remit donations before the 31st

than one donation is being remitted, enter

111 E. 17th Street

day after the date of receipt.

the date of the earliest receipt.

Austin, Texas 78774-0100

item 7 - Enter the number of individual dona-

WHO tO cOntact fOr assistance–

tions received.

You have certain rights under Chapters

For assistance, please contact the Texas

item 8 - Enter the total amount of donations

552 and 559, Government Code, to review,

State Comptroller’s office at

received.

request and correct information we have on

(800) 531-5441, ext. 3-4276, or call

file about you. Contact us at the address or

item 9 - Enter the total amount due and

(512) 463-4276.

phone numbers listed on this form.

payable for this report.

1

1